On Boat Rocker's ($TSX.BRMI) Content Investments

After a recent sale, Fairfax-controlled Boat Rocker trades below net cash with valuable B/S assets despite historical profitability, a lower-risk content strategy going forward, and potential buybacks

Situation Overview

Boat Rocker Media ("Boat Rocker", "$TSX.BRMI", or "the Company") is a small (~CA$55m market cap) independent Canadian entertainment company that creates, produces, and distributes TV content across genres, including scripted and unscripted (e.g. reality TV, documentaries), live-action and animated, and general and kids/family programming.

Over the years, Boat Rocker has produced global TV franchises you may recognize, including Being Erica, The Next Step, and Orphan Black. More recently, the Company has produced shows such as Invasion (Apple TV+), Palm Royale (Apple TV+), American Rust: Broken Justice (Prime Video), Beacon 23 (MGM+), and Dino Ranch (Disney+, Disney Junior, CBC).

Today, the Company has a library of over 9,500 half hours of content (both owned and third-party) that it sells to buyers around the world including linear TV channels, over-the-top ("OTT") platforms like Netflix, and third-party distributors.

Founded in 2003 as Temple Street Productions by former entertainment lawyers and current Co-Executive Chairmen Ivan Schneeberg and David Fortier, Boat Rocker capitalized on early successes to raise capital from BBC and Prem Watsa's Fairfax Financial ("Fairfax"), diversifying and transforming the Company into a full-service content studio through M&A (nine acquisitions completed between 2016-2019).

The Company IPO'd in early 2021, with Fairfax maintaining majority control (~44.9% equity ownership, ~56.1% voting interest). Schneeberg, Fortier, and CEO John Young are material owners (collectively ~18.0% equity ownership, ~36.1% voting interest) as is Wellington Management (~7.2% equity ownership, ~1.5% voting interest). Shares are tightly held with <30% free float.

In June 2024, the Company announced the divestiture of its 51% interest in leading talent management company Untitled Entertainment ("Untitled") to TPG for ~CA$52.1m (with minimal tax leakage). In addition, the Company received an ~8% interest in The Initial Group, a new talent management company formed by TPG (previous owners of Creative Artists Agency, better known as CAA) and anchored by Untitled to acquire, invest behind, and build a business centered on talent management and representation.

Following the transaction, Boat Rocker is incredibly cheap, trading below the value of its cash balance even without ascribing any value to The Initial Group or owned content assets.

My calculation of the Company's enterprise value can be seen below:

Notes:

'Cash Ear-Marked for Production' refers to the portion of cash that is required for the funding of productions in progress and is therefore not available for other uses

'PF - Insight Put' refers to the assumed cash outflow associated with the Company's purchase of the remaining 30% stake in Insight, a producer of Canadian reality TV, following the exercise by the non-controlling shareholder of a put option at fair value. Non-controlling interest of ~CA$5.8m on the balance sheet in relation to Insight not included in EV as a result

EV excludes ~CA$104.4m of non-recourse interim production financing, given this is a form of bridge financing backed by tax credits and licensing/production payments expected to be paid at later dates. Discussed in more detail later

The market clearly does not believe excess cash will be returned to shareholders or be used for positive ROI projects. Is this fair? At first glance, you may be inclined to say yes - Boat Rocker has utilized excess capital for M&A and content reinvestment in the recent past, driving negative FCF each year from FY19-FY22 (net of lease payments).

But a closer look shows that the Company has generated >CA$100m in FCF from FY23 to YTD Q2 FY24, driven in part by a lower-risk content strategy in the face of a more depressed industry environment following peak FY22 levels. Looking further back, the Company was consistently profitable for over 12yrs prior to its IPO, pointing to a management team that is focused on cash economics, with no M&A completed since FY19.

This, coupled with recent disclosures pointing to potential share buybacks (highly accretive at current trading prices), an incentivized, rational owner in Fairfax who has invested well over CA$100m in the Company (and recently took microcap Farmers Edge private; Boat Rocker director and Fairfax investor Quinn McLean is also a board member at Farmers Edge), and additional (albeit difficult to value) balance sheet assets in the face of a below cash valuation make this a compelling opportunity with downside protection.

Analysis

First, let's start with our downside - The Company currently has a market cap of ~CA$55m. What would you own if the Company hypothetically burned all its cash on negative ROI productions or poor M&A?

An ~8% interest in TPG-controlled talent management company The Initial Group, valued by the Company based on the Untitled transaction at ~CA$11m. TPG is an incentivized, experienced operator in this space and would hopefully look to grow the value of The Initial Group over time

Other equity investments owned by the Company with a book value of ~CA$8m, including a 10% ownership stake of TeaTime Ventures, a production company founded by Dakota Johnson and Ro Donnelly

The Company's owned content library, stated at ~CA$69.6m on the balance sheet, net of amortization (based on delivered vs. in-production/development content). This is difficult to accurately value given the Company's IP varies widely in quality, although there are likely some valuable parts of the portfolio, including Dino Ranch (previously the #1 U.S. cable series among Kids, 2-5, with the Company developing a broad licensing program for the series, including toys)

30% of Insight, a producer of Canadian reality TV including The Amazing Race Canada and MasterChef Canada representing just one of many of the Company's subsidiaries, which the Company did not already own was sold to Boat Rocker through an exercised put agreement after quarter-end at fair value (as agreed by the parties or as determined by an independent appraisal). The implied valuation of 100% of Insight alone based on this transaction is ~CA$25m

Separately, the Company believes it owns one of North America’s largest independent 2D and 3D computer graphic animation studios focused on TV production

Clearly, this Company has assets that are likely worth something to someone in a downside case, which is a good starting point. Of course, you would hope that any cash investments would generate at least some additional value.

Next, we can try to understand the Company's historical cashflow position and what to expect going forward. Note that this is a complicated, lumpy, often hit-driven business with many accounting quirks - I'm absolutely no expert and I'm sure I'm overly simplifying/missing nuances. For those interested, you can see a more detailed explanation of the Company's business model in the 'Business Model' section.

As discussed, the Company embarked on a growth and diversification strategy through M&A from 2016 onwards. Is it possible that the Company over-invested in M&A and infrastructure, driving negative FCF from FY19-FY22? Absolutely.

Boat Rocker’s history through its IPO

But there's another dynamic - As a producer of content, Boat Rocker invests capital to cover production-related fees upfront (if it chooses to maintain IP ownership). This means that cash outflows are higher when programming is being produced. This is particularly true for premium, scripted dramas, which the Company meaningfully entered into with its FY19 acquisition of Platform One Media (now known as Boat Rocker Studios, Scripted; The producer is behind Invasion and American Rust).

Importantly, Boat Rocker does not put up all upfront production investments itself. As part of distribution agreements signed prior to production commencement, buyers of content (e.g. Netflix) offer content producers upfront cash advances or minimum guarantees on production delivery. In addition, the Company receives assistance from several government programs designed to support content production. Boat Rocker then uses non-recourse financing (called interim production financing) backed by these cash inflows to bridge timing differences between cash receipts and funding of production costs.

From FY20-FY23, the Company invested ~CA$750m in content, receiving an offsetting ~CA$1.1bn in deferred revenue cash collections (largely buyer upfront advances and minimum guarantees that I think of as production financing, although others may disagree) and fronting an additional ~CA$110m in investments expected to be reimbursed by the government through tax credits. Said differently, content production was largely funded by buyers (although timing was bridged through interim production financing).

In return, the Company generated ~CA$1.4bn in revenue (excluding the Representation segment, which was made up of Untitled), offset by ~CA$1.1bn in deferred revenue recognition already accounted for above and ~CA$700m of COGS and G&A (including leases, excluding amortization).

Taken together, the Company had a net production cash outlay from the above investments of ~CA$150m. There are of course cashflow items for other working capital, cash taxes/interest, the Company's Representation segment, etc., but this is the main driver of the Company's ~CA$100m FCF outflow over the period (net of leases). FCF shortfalls were largely financed by ~CA$30m in interim production financing and ~CA$70m of net IPO proceeds (after debt paydown).

This analysis isn't entirely fair - If the Company were to stop reinvesting in content production, you would expect cash inflows from the rolling off of working capital investments and high-margin post-production revenue. This helps explain the Company's >CA$100m in FCF generation from FY23 (~CA$60m) to YTD Q2 FY24 (~CA$40m), driven by lower production revenue in the face of more difficult macro and slowing industry conditions/spending following 2023 writer/actor strikes and aggressive investments related to the 'streaming wars' through 2022.

As a result, I'm not entirely sure if the large investment in content production through this period was a poor capital allocation decision by management, despite negative FCF. Again, the content was largely funded by buyers (with the Company likely able to take advantage of the exuberant post-COVID funding environment) and, as owned IP, could possibly generate additional cashflows in the future.

In any case, we don't know how much net cashflow the Company will ultimately generate from its large, premium investments in FY20-FY23, if any, nor do we know the normalized FCF generating power of the Company based on its ~CA$69.6m in produced, delivered content value on the balance sheet. We do know the following:

Since the beginning of FY24, Boat Rocker has increasingly pursued a lower-risk content strategy, in which the Company has focused on finding projects that are essentially finished, owning a portion of the IP, and selling the content around the world through its strong distribution team. This is not to say that the Company won't pursue development activities, but rather that management sees a better opportunity for returns with these types of investments in the current environment

We're using the money to buy IP. And I think the shift in strategy is, we're spending less money at the very early stages of development and trying to spend more money on causing IP to get created. So, we're trying to be closer to last money in. So, we're assured that that money is going to, if we've got our calculations right, generate a return. We're trying to get a little bit, significantly closer to the finished product to ensure that every dollar we spend manifests into a piece of IP that can generate a return and be added to our library. - Ivan Schneeberg, Q1 FY24 Earnings Call

We're focused much more, as Dave said there, on the IP investment strategy that leans into the distribution team, getting access to content, distributing it and monetizing it. And that will allow us, again, to manage costs and to streamline more of the business in the next six to 12 months. - John Young, Q2 FY24 Earnings Call

Fairfax Shareholder Letter - 2023

The Company was historically consistently profitable before the aforementioned FY19-FY22 period per Fairfax. It's ambiguous as to what measure of profitability Watsa is referring to, but regardless, Boat Rocker does not seem to me to be a typical money-losing business with a management team unfocused on underlying economics

Fairfax Shareholder Letter - 2018

Fairfax Shareholder Letter - 2015

In addition, there are multiple indications that the Company is interested in using a portion of its cash for share buybacks going forward, including the below quote from the CEO (which seems to me to be the strongest reference to a buyback they've made despite having NCIB authorization in the past; Management is frequently questioned by analysts about buybacks):

In addition, where possible, we're also intending to deploy capital to repurchase our shares pursuant to our current NCIB. - John Young, Q2 FY24 Earnings Call

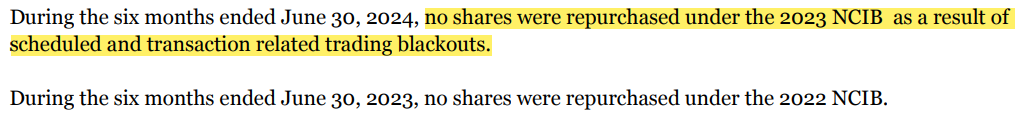

More important to me are new references in the financials to the fact that shares were not repurchased in H1 FY24 due to "scheduled and transaction-related trading blackouts," presumably in relation to the Untitled transaction. Below I've included screenshots from both the Q1 and Q2 FY24 financials, with no such language in the former.

Financials - Q1 FY24

Financials - Q2 FY24

This is clearly a conscious change by the Company - I don't see why they would add such a qualifier if they didn't anticipate buying shares outside of the blackout period. Given the Company's current valuation, any repurchases would be highly accretive, although it may be difficult for the Company to deploy substantial capital towards buybacks given low trading liquidity. We'll see what happens, but I wouldn't be surprised to see the Company disclose repurchases in the coming weeks/months.

Overall, Boat Rocker is a historically profitable company that either over-invested or took advantage of loose financing around the time of its IPO, driving negative FCF. Regardless, the Company is shifting towards lower-risk content strategies and potential return of capital to shareholders. Under Fairfax, I expect the Company to continue driving towards consistent profitability or ultimately monetizing its valuable balance sheet assets, namely its stake in The Initial Group and owned content library.

Business Model

There are three primary stages in Boat Rocker's business model that are simplistically covered below.

The first is IP sourcing, which the Company does through multiple channels. Examples include acquiring or licensing existing IP (through books, comics, original pitches, etc.), co-developing IP through various arrangements/partnerships with content creators and other production companies, and originating IP in-house.

Once IP has been identified, Boat Rocker engages in IP assessment, determining how much ownership it would like to maintain in the sourced IP (and therefore how much of its own capital it will need to invest for production). This depends entirely on the Company's subjective view on the long-term IP potential.

If the Company chooses to use its own capital to fund production, it will typically maintain economics associated with that IP. However, even when Boat Rocker fully owns the IP, it usually will not fund the entire project itself. Instead, production is financed in two main ways:

Pre-sales: The Company sells or licenses distribution rights (think of this as the right to broadcast content to viewers in a particular region for a particular period of time) to end-buyers of the content (e.g. linear TV channels, OTT platforms like Netflix, etc.) or third-party distributors before commencement of production. This is called a 'pre-sale'. Production is considered 'greenlit' once programming has officially been contracted for production, typically at the point where the Company has received commitments for all required financing through pre-sales to cover the cost of producing the content. The Company refers to these pre-sales as 'production revenue' (~77% of PF FY23 revenue)

Pre-sales may involve cash advances during production at the completion of certain milestones and/or minimum guarantees (in which the buyer agrees to pay a fixed amount of money upon delivery of the content). My understanding is that any upfront payments ahead of production delivery are recognized as deferred revenue on the balance sheet

Tax Credits: The Company also receives assistance from several government programs designed to support content production in Canada and internationally, referred to as tax credits

Boat Rocker then utilizes interim production financing provided by banks to bridge timing differences between the receipt of pre-sales, government assistance/tax credits, and the funding of production costs. On collection of buyer and government financing, interim production financing is typically repaid within 30 days.

Importantly, interim production financing is non-recourse, specific to individual seasons of production, and backed by licensing/distribution and tax credit agreements as collateral. Interim production financing is presented as a current liability given these loans are repayable upon demand by the lenders (industry standard), but typically are only paid when collateral is received (which can take up to 6 months to 3yrs in certain situations).

From an accounting standpoint, once production has commenced, all direct production and financing costs incurred during production are capitalized. Federal/provincial program contributions, production tax credits, and production financing provided by 3rd parties that specifically acquire equity/participation rights are recorded as a reduction of the cost of content. Once the content itself is delivered to buyers, it is amortized based on the expected economic life of the program (based on management's judgment on the Company's ability to license the content, availability of secondary markets, demand for merchandise, etc.).

Separately, the Company may choose to sell IP to a buyer who fully funds the cost of production, allowing the Company to pursue lower-risk fee-for-service projects. The Company refers to these sales as 'service revenue' (~15% of PF FY23 revenue).

The last step is IP monetization. After pre-sales, the Company generates incremental revenue from selling or licensing distribution rights in other regions not covered by pre-sales or in existing regions after pre-sale agreements expire. Additionally, the Company looks to exploit other rights associated with owned-IP, including merchandising, and can also distribute 3rd-party IP on behalf of customers. The Company refers to these sales as 'distribution revenue' (~7% of PF FY23 revenue).

Great idea. Quick question about the business model: am I understanding it correctly that the production revenue is a fake revenue? Say a new production has a budget of 10M, the company pays 2M and 8M are covered by pre-sale. Then right after the delivery of the product, the company 'loses' or you could say invest 2M. For me this whole process is more like capital expenditure and the corresponding asset Investing in contents is like PPE. The point is to generate revenue from such 'PPE' in the future (distribution Revenue).

I know nothing about this industry so I could be completely wrong about this..

Anything worth updating for this dumpster fire?