On Centaur Media's ($LSE.CAU) Main Brands - The Lawyer and MW Mini MBA

Despite transforming into a recurring, digital subscription business with high margins and negative W/C, Centaur has seen its stock decline 20% over 5yrs due to headline results and exogenous factors

Situation Overview

Centaur Media ("Centaur", "$LSE.CAU", or "the Company") is a small (<£50m market cap) business information, training, and events company focused on the legal and marketing professions. Its main offerings include the industry-leading, trusted publications The Lawyer and Marketing Week, as well as a portfolio of rapidly growing eLearning courses for marketing professionals under the MW Mini MBA brand.

Founded in 1982 by Graham Sherren, Centaur was once a sprawling, formidable group of trade magazines, with a focus on B2B publications. At the time of the Company's IPO in 2004, Centaur owned 25 magazines across seven sectors: Marketing, financial services, creative services, legal services, new media, construction, and engineering.

Notable brands at this time included Marketing Week and The Lawyer, among other brands such as Money Marketing, New Media Age, and Homebuilding & Renovating, with revenue principally derived from advertising (display, recruitment, etc.) and magazine sales. In addition to publications, the Company owned 17 exhibitions, 63 conferences, and 21 awards.

In the ensuing decades, Centaur's traditional print publishing business lost significant ground to digital players due to underinvestment and poor M&A. In 2018-2019, the Company finally decided to simplify and shift to digital, choosing to focus on the marketing vertical with the expectation of divesting everything else.

The majority of brands were sold/shut down, but the one caveat was The Lawyer - The Company ended up keeping this brand due to inadequate bids vs. management/board expectations (bids in the region of ~£25m vs. ~£40m expected). Today, the Company has just 10 brands across its two key verticals of marketing and legal.

Since these divestitures and post-COVID, Centaur has completely transformed its business model. The publication portion of the business (referred to as 'premium content') is now almost entirely digital. Importantly, this revenue line item only makes up ~41% of total FY23 revenue, with a further ~40% of revenue coming from new eLearning businesses (referred to as 'training and advisory'). Another 10% of revenue comes from events.

The Company describes these three revenue streams as 'strategically valuable', representing areas of focus for the management team. This makes sense - These are recurring, often subscription-based revenues with high margins and operating leverage. ~90% of Centaur's FY23 revenue is considered strategically valuable, up from just ~55% in FY19.

This shift in revenue has seen the Company's EBITDA margins expand materially from ~9% to ~26% over this period and invested capital shift negative, with the Company's growth now financed principally by suppliers and customers (in the form of A/P and deferred revenue, respectively).

Centaur financial data. EBITDA presented per management's definition (i.e. excluding lease costs).

As a result, Centaur is highly cash-generative today. The Company generated £14.3m of cumulative FCF from FY21-FY23 (~40% of current enterprise value).

In addition to an acceleration of the digital strategy as a result of COVID, these results came down to stringent operating discipline by the Company's management. CEO Swag Mukerji joined the Company in 2016 (initially as CFO from 2016-2019) and has since overseen the acceleration in recurring, high-margin, less capital-intensive businesses and strict cost control. Mukerji has been willing to make difficult decisions, including closures/divestitures of underperforming brands and a downsizing of the Company's headquarters in FY23.

Unfortunately for the Company's long-term shareholders, the market has not given Centaur credit for its transformation initiatives, with the Company's stock down by >20% over the past 5yrs (excluding dividends, namely a £2.9m special dividend in FY19 and a £7.2m special dividend in FY23).

Centaur's share price over the past 5yrs.

Why?

Centaur's progress has largely been masked by its headline results. To someone with no knowledge of the transformation, Centaur's revenue appears to have declined at a ~7% CAGR from FY19-FY23. In reality, this was due to fluctuations in non-strategic revenue (now <10% of revenue) and divestitures/closures of underperforming brands. Strategically valuable revenue actually increased at a ~6% CAGR over this time period.

More recently, the Company has seen macroeconomic challenges impact non-strategic and certain marketing-related brands. In H1 FY24, revenue and EBITDA declined 8% and 26% YoY, respectively, driven by client budget constraints and reinvestment into the business. However, key focus areas for the Company, including The Lawyer, MW Mini MBA, and Marketing Week showed flat to positive results. Management expects growth and margin recovery in H2.

This dynamic, coupled with generally poor sentiment in the UK for microcaps and very low trading liquidity for Centaur's stock (~25% free float, with ~65% of shares controlled by 5 funds), seems to have driven the share price. In recent months, downward pressure on the stock price has been further exacerbated by the ongoing wind-down of the Downing Strategic Micro-Cap Investment Trust, which owned <3% of the Company's shares as of 7/31/24 vs. ~4.6% at 3/31/24.

It seems clear to me that Centaur trades well below its value to a private owner. This is particularly true given the Company's capital structure, with no debt and therefore substantial financing capacity. Over time, I expect the market will catch on to this as the Company's consolidated results continue to improve.

There are signs this is already happening - In April 2024, Centaur announced it had received a "highly preliminary expression of interest" in a potential transaction from Waterland Private Equity Investments ("Waterland"), a Dutch private equity firm, driving the Company's share price up 30%+ to ~50p/share.

Again, this offer was highly preliminary, and, in May 2024, it was announced that Waterland did not intend to pursue any transaction with Centaur. The Company's stock price has since cratered (down 40%+).

I can't speculate on why Waterland did not choose to move forward with a bid, but I still think this is an incrementally positive point - Market participants are starting to realize that this is an attractive portfolio of assets. In any case, these are assets I would personally like to own.

Company Overview

As mentioned, Centaur is a business information, training, and events company. The Company has two main divisions, each focused on a key vertical:

The Lawyer (23% of FY23 revenue) - Focused on the legal profession

Xeim (77% of FY23 revenue) - Focused on the marketing profession

Centaur is effectively two businesses with no real synergies/overlap. The holding company provides supporting infrastructure. As a result, it makes sense to analyze each segment separately.

It's easy to get lost in the details given Centaur's disclosures (or lack thereof) and many brands, but there are really only two that matter: The Lawyer and MW Mini MBA. For our purposes, we'll only focus on these.

The Lawyer

23% of FY23 revenue, 29% of FY23 EBITDA including corporate and lease costs with ~31% EBITDA margins

Brands: The Lawyer

The Lawyer is a sticky, recurring, highly cash-generative property that, in my view, is Centaur's crown jewel.

The brand is a digital, corporate-focused subscription publication that aims to provide partners and senior legal professionals in top law firms and corporate legal departments with news, data, and analysis on the business of law, with a focus on the UK.

The Lawyer's homepage as of 9/3/24.

The Lawyer is one of the most important publications servicing the legal profession in the UK - Today, the brand has 4.8m annual visitors to its website, a 28% daily open rate for its early-morning commentary, and subscription offerings used by 91% of the top 50 UK and top 50 US law firms in London.

Importantly, this is a highly sticky product offering (100%+ renewal rate as of H1 FY24) with substantial pricing power (24% YoY increase in the average value of 'higher value accounts' in each of FY22 and FY23).

Founded in the late 80s, The Lawyer has spent decades building a reputation as a trusted brand through content production, first as a weekly/monthly physical magazine and now as a digital publication. The KPIs above clearly demonstrate the importance of The Lawyer's services to top legal teams in the UK.

To give you a sense of how The Lawyer is perceived in the UK, see below the top comment from a Reddit thread about prestigious law magazines/blogs from a few years ago. This is highly anecdotal, but nonetheless a decent endorsement of the publication in a niche, UK lawyer-focused forum:

Reddit thread on r/uklaw mentioning The Lawyer.

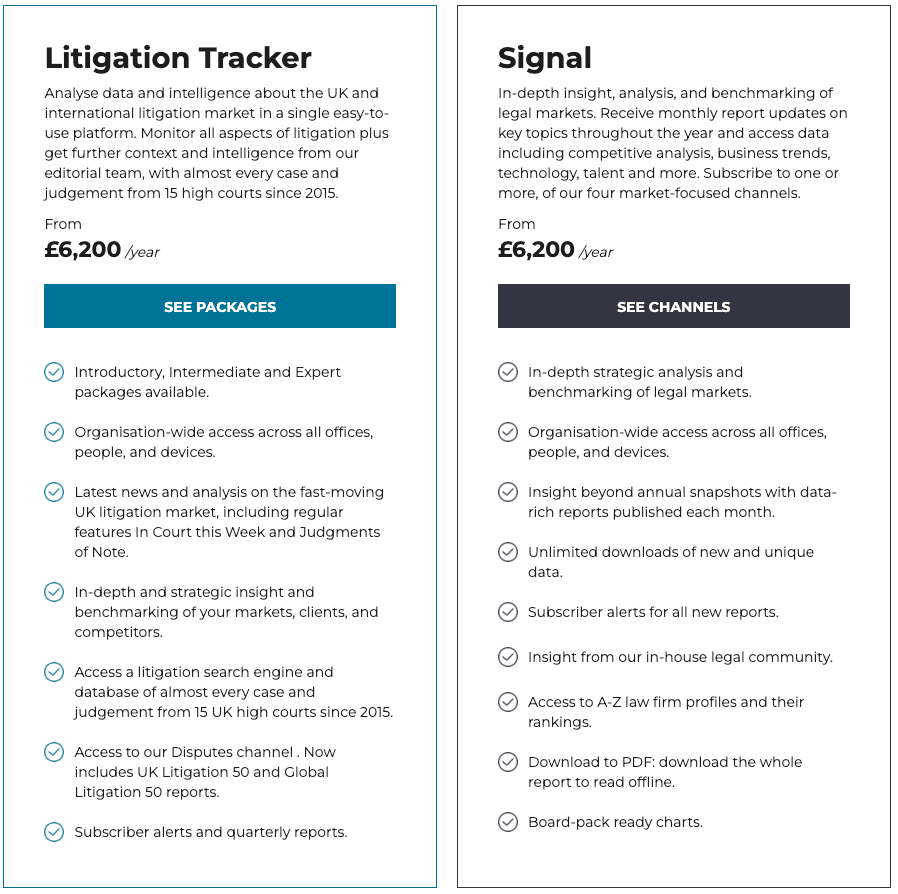

The brand's main offerings can be seen below - In addition to industry-related news/commentary, The Lawyer is increasingly leveraging its difficult-to-replicate firm-specific and market-level data collected over 30yrs+ (including rankings, salaries/team sizes, trends, etc.) to offer insight and analytics products such as 'Litigation Tracker' and 'Signal'.

Also, note the pricing below. To reiterate, The Lawyer is focused on corporate subscriptions, with individual offerings priced in the thousands of pounds.

The Lawyer's subscription products and pricing.

~62% of The Lawyer's FY23 revenue is from premium content (i.e. the products above), up from just ~41% in FY19. Driven by pricing power, the successful transition to digital, and new products, The Lawyer has seen premium content revenue and digital subscriptions within this revenue line grow at an ~11% and ~23% CAGR, respectively, since FY19.

I estimate that subscriptions have grown from ~65% of The Lawyer's premium content revenue to ~94% over this same time period. Said differently, subscriptions seem to have increased from ~27% of The Lawyer's total revenue in FY19 to ~58% in FY23. This has driven substantial expansion in the brand's EBITDA margins (including corporate costs, excluding leases) from ~25.9% in FY19 to ~33.2% in FY23. Clearly, the quality of The Lawyer's revenue has increased over time.

A further ~21% of The Lawyer's FY23 revenue is from events - The publication has been able to leverage its trusted brand name to create the prestigious 'The Lawyer Awards' as well as conferences focused on top-legal professionals including the General Counsel Strategy Summit, the Legal Transformation Summit, and Horizon Live.

Both premium content and events have continued to grow, despite recent macro headwinds - The Lawyer's H1 FY24 revenue and EBITDA increased 7% and 3% YoY, respectively, driven by an 8% growth in premium content (102% renewal rate and a doubling of new business) and 15% growth in events. Non-strategic, lower-margin marketing and recruitment advertising solutions revenue made up ~17% of FY23 revenue and declined ~11% YoY in H1 FY24 - This part of the business is expected to fall away over time.

This is clearly an attractive asset - The Lawyer is a trusted, important property for customers, with substantial retention/resiliency (as seen by recent growth and growth during COVID) and opportunities for further growth in both premium content and events in the form of pricing, new products, and international expansion into Europe and the U.S. Additionally, the brand has high EBITDA margins (~40% at the segment level) with substantial operating leverage, a negative working capital cycle (upfront subscription payments), and requires almost no capex to grow.

Xeim

77% of FY23 revenue, 71% of FY23 EBITDA including corporate and lease costs with ~22% EBITDA margins

Brands: MW Mini MBA, Marketing Week, Econsultancy, Influencer Intelligence, Festival of Marketing, Oystercatchers, Fashion & Beauty Monitor, Foresight News, Creative Review

Xeim is an umbrella of nine marketing brands, specifically focused on providing marketing intelligence and marketing-related training services.

Xeim's largest, fastest-growing, and most valuable brand is MW Mini MBA, making up ~39% of the segment's revenue as of H1 FY24. Founded in 2016, MW Mini MBA provides business school-level online flexible/applied learning for marketing professionals (particularly those without formal marketing training), helping them transition into senior roles.

Since its founding, MW Mini MBA courses have been taken by ~30k learners across 92 countries (with a current active alumni community of ~5k individuals). The brand's current portfolio consists of three courses aimed at marketing professionals - Mini MBA in Marketing, Mini MBA in Brand Management, and Mini MBA in Management (launched in September 2023). Courses cost ~$2.5k/user.

MW Mini MBA's portfolio of courses.

MW Mini MBA has been extremely successful since its launch, obfuscated by other brands in the segment (given the Company does not break out revenue/profit by brand). The brand has an NPS score of 69+ (90%+ would recommend the course, ~95% feel more confident after doing the course) and has seen active learners participating in courses increase at a ~22.8% CAGR from FY19-FY23.

Revenue has likely increased at an even faster pace - The publication Flashes and Flames estimates that revenue has increased at a ~44.3% CAGR from FY19-FY23 to ~£13m in FY23, driven by pricing initiatives. The publication further estimates ~£4m in segment-level EBITDA (i.e. ~29% segment-level EBITDA margins).

I don't know how Flashes and Flames (a reputable, media-focused subscription newsletter) derived their numbers, but they're broadly in line with how I think about the brand. Arbitrarily assuming 35% of both revenue and segment-level EBITDA attributable to MW Mini MBA, I get to FY23 revenue and EBITDA of ~£10m and ~£3m, respectively.

The point clearly still stands - MW Mini MBA has grown incredibly rapidly. This is despite volumes actually declining by ~18% in FY23 vs. peak FY21 levels (driven by aforementioned pricing initiatives).

A simple Google search shows a huge amount of positive feedback for the MW Mini MBA program, including this in-depth review (which I recommend to get a comprehensive understanding of what the courses entail). Importantly, MW Mini MBA seems to consistently be recommended above the Chartered Institute of Marketing ("CIM") certification (a principal competitor).

Again, highly anecdotal, but see below the top comment recommending MW Mini MBA on a Reddit thread asking about CIM:

Reddit thread on r/marketing recommending MW Mini MBA over CIM.

What is MW Mini MBA's secret? A huge part of the brand's value proposition comes from Mark Ritson, the brand's founder who specifically teaches the Marketing and Brand Management courses.

Ritson is a very well-known, highly charismatic brand consultant and marketing professor with an easy-to-follow teaching style. His name is plastered over the MW Mini MBA's website and serves as a huge draw for individuals and corporations alike (notice his name mentioned in the screenshot above).

He's a lot of fun to listen to and clearly a great marketer - The below video gives you a sense of Ritson's style and what to expect from the flagship Mini MBA in Marketing course:

The brand is highly dependent on Ritson, and his arrangement with the Company reflects this - Flashes and Flames estimates that Ritson has a whopping 50% contractual revenue share agreement with Centaur for MW Mini MBA's sales. This is a huge number, but I estimate the brand is still generating ~30% segment-level EBITDA margins even after these payments.

Again, I can't verify Flashes and Flames' claims. Is dependence on Ritson a risk? Definitely so, although Centaur has previously indicated that the Company has a long-term arrangement with Ritson and is increasingly positioning Ritson as the dean of the school, bringing in other professors to teach new courses (such as the Mini MBA in Management). It remains to be seen how this will impact growth rates. However, if the contractual arrangement is true, I don't think Ritson will be itching to leave any time soon.

Regardless of the above, this is clearly a valuable business. MW Mini MBA has some great financial characteristics that are similar to The Lawyer, including likely pricing power, high EBITDA margins (~30% at the segment level) with substantial operating leverage, and a negative working capital cycle (upfront course payments). In addition, the brand has exhibited rapid growth (with a high NPS), a large potential TAM, and a valuable (and increasingly monetized) alumni network.

While MW Mini MBA exhibited flat revenue growth YoY in H1 FY24 in a difficult macro, the brand should return to volume growth over time from increasing corporate sales, international expansion, and new courses (with an increasing focus on lifelong learning).

The brand does require capex to create/release new courses and constant customer acquisition (given most individuals will likely only complete one course), but such reinvestment is particularly attractive given opportunities for rapid learner expansion and operating leverage.

MW Mini MBA's increasing focus on lifelong learning, driving expansion in customer lifetime value.

Analysis

Does the Company's current valuation appropriately reflect the value of The Lawyer and MW Mini MBA, along with the Company's other brands?

My calculation of the Company's enterprise value and valuation multiples are below:

Notes:

EBITDA is adjusted for IFRS-16 (lease payments are deducted from operating profits).

Owner earnings are based on my own estimates, calculated as FY23 EBITDA incl. leases (~£8.9m) less cash taxes (~£1.7m, based on 25% UK tax rates) less NWC (~£0.0m, in line with FY22; NWC outflow in FY23 due to timing), less capex (~£1.3m, ~3.5% capex margin in line with FY22; 5.6% capex margin in FY23 due to growth capex for new MW Mini MBA course).

You can absolutely disagree with my calculation of owner earnings - Actual results will be much lower in the coming year given macro issues I mentioned previously and Centaur's reinvestments for growth, but I think the Company will see EBITDA expand over time.

Regardless, Centaur generates a substantial amount of cash. ~25% of cashflow from operations generated since FY20 has been returned to shareholders in the form of dividends (excluding £7.2m in special dividends paid in FY23 that are not expected to be paid going forward). I expect that number to remain relatively constant going forward, with the remaining ~75% of cashflow reinvested into the Company for growth.

It's difficult to say exactly what rates of return Centaur will get on these investments, but the Company is seeing revenue growth at its core brands already. These are attractive brands with what I think are sustainable advantages and large reinvestment runways, particularly at MW Mini MBA. Over time, I expect the consolidated entity to grow.

An easier way to understand Centaur's current valuation is through a sum-of-the-parts analysis. Centaur currently has an enterprise value of ~£38m. We know that The Lawyer was valued by bidders in the region of ~£25m in 2019 (although the Company valued the brand at ~£40m). This was before rapid growth in the brand's digital subscriptions, introduction of new products, and substantial cost-cutting.

Other legal/UK publishing assets (with varying levels of digitization and corporate sales) seem to trade in the 8-12x EBITDA range in transaction scenarios, including American Lawyer Media, The Economist, and Dennis Publishing. Given The Lawyer's revenue growth, retention, digital and corporate focus, etc., let's assume the brand should conservatively be valued at 10x FY24E EBITDA after corporate and lease costs (but feel free to choose your own number). On this basis, I get to a valuation of ~£28m for The Lawyer.

That leaves ~£10m in enterprise value that the market is ascribing to the Company's remaining brands. Let's assume the market is only giving the Company credit for MW Mini MBA, which I estimate alone produces £2.5m in EBITDA after corporate and lease costs.

It's difficult (and irrelevant) to estimate exactly what this brand should be valued at. At Centaur's current stock price, MW Mini MBA's implied valuation is ~4x EBITDA, which seems too low given the growth rate, margin profile, and reinvestment opportunity discussed previously.

Of course, the Company's other brands (which I estimate produced £3.5-4m in FY23 EBITDA after corporate and lease costs) likely have value as well, despite recent macro pressures. The most notable remaining brand is Marketing Week, a well-known online publication under the Xeim umbrella that offers news, opinions, trends, etc. focused on the marketing industry. Today, Marketing Week makes up an immaterial portion of the Company's overall revenue (<£1m in sales). However, the brand is leveraging The Lawyer's playbook and increasingly shifting to a paywalled content strategy. Centaur sees a path to ~£3m in high-margin revenue over the medium term, meaning this could be a valuable asset to the Company in the future.

There is no immediate catalyst to unlock Centaur's value, but I think the Company currently trades well below its value to a private owner. With a management team that has shown operating discipline and a willingness to shed underperforming brands, along with recent PE interest, Centaur is starting to gain recognition for its multi-year transformation. These are a set of assets that I think can continue to grow and that I would like to own over time.

Thank you! Excellent overview of a very interesting situation,

Loved the article! Good stuff