On Harbor Diversified ($HRBR) and Air Wisconsin

Harbor currently trades at net cash despite a seemingly profitable regional airline business and long-term private equity owners with a strong track record that are buying back shares

Situation Overview

Harbor Diversified ("Harbor", "$HRBR", or "the Company") is the owner of Air Wisconsin ("AW", "the Airline"), a regional airline that operates short and medium-haul flights on behalf of American Airlines ("AA"), conducting business under the 'American Eagle' brand since March 2023. AA has essentially been the sole source of revenue for the Company since June 2023.

Through AW's fleet of 63 fully owned, small (50-seat), older (average age of >20yrs) CRJ-200 regional jets and >400 pilots, the Airline flies from AA's larger hub cities (Chicago and Philadelphia) to smaller cities (e.g. Appleton). In Q3 FY23, the Airline carried ~660k customers across ~16k flights with an average distance of ~290 miles.

Despite being an illiquid microcap with a $100m market cap in a famously hated industry (Warren Buffett once quipped: “If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright"), Harbor has been well covered by analysts, especially relative to the types of names I usually like to write-up.

I've included just a few write-ups below that I'd point you to if you want to learn more about the Company:

VIC: Value Investors Club

Investor Letters: Alluvial Capital, Arch Capital

Twitter: Jeremy Raper

All the interest makes total sense - Harbor is incredibly cheap. To highlight this, we'll flip my usual write-up structure around and start with my calculation of the Company's enterprise value and valuation multiple, which can be seen below:

Note: ~$7m in legal costs spent in Q2-Q3 FY23. Assumes a similar balance through Q1 FY24 (i.e. the end of the legal dispute)

At current levels, Harbor has no debt and is trading for roughly the value of its cash and marketable securities (undisclosed but made up of ETFs and mutual funds), even without ascribing any value to its owned regional jets. Said differently (and far too simplistically), if you had ~$100m, you could buy up the entire Company, liquidate it to get 90% of your money back, and be left with 63 50-seat airplanes, a large pilot force during a pilot shortage in the U.S., and a contract to fly for AA through 2027.

There are usually two reasons a company trades at or below net cash:

Value-destructive capital allocation - The company actively uses cash to invest in negative ROI projects (greater cash use than future cash generation, e.g. poor acquisitions) or simply refuses to ever return cash to shareholders through dividends, buybacks, etc.

Cash-burning operations - The company's core business burns cash without making a profit, meaning that cash on the books will be lower tomorrow than today

I'd argue that Harbor has neither of these characteristics and thus that the current valuation is too low. The Company is ~60% owned by a group of competent, talented private equity investors associated with Resource Holdings. These investors have a strong track record and have incredibly owned AW for over 30yrs, managing to keep the Airline alive (despite an aging fleet) while numerous competitors have gone out of business.

These owners are of course not without faults - There have clearly been actions that hurt minority shareholders over the years, but their capital allocation skills shouldn't be understated. In recent years, the Company has begun to engage in share buybacks, which is a positive development for minority shareholders.

I also think the Company will generate positive FCF going forward, as it has for years prior to the AA deal. There have been questions as to whether the AA contract, which was only signed in early 2023, will be profitable for AW, but there are two dynamics to keep in mind when thinking through this. First, AW is clearly an important partner for AA to achieve economies of scale by reaching smaller cities (particularly during a pilot shortage). Second, the Company has long-term, savvy private equity owners that would likely choose liquidation or another corporate action over burning cash in an unprofitable contract.

Given the above, I would be surprised if the AA contract was unprofitable. Most importantly, the financials point to a profitable contract - The Company showed positive EBITDA in Q3 FY23 (after adding back non-recurring legal costs).

The rest of this write-up will focus on supporting the above claims by looking at the Company's value proposition and diving deeper into AW's ownership and capital allocation, which I feel hasn't been covered in other write-ups.

But first: Why is now the right time to look at Harbor?

From FY17-FY22, AW generated ~100% of its revenues by operating regional flights for United Airlines ("United"). Throughout this arrangement, United and AW had various disputes regarding the contract and amounts owed by United, ultimately culminating in United initiating arbitration in October 2022 regarding ~$52m worth of payments that AW felt it was owed (and had recorded as revenue on the books). This disagreement, coupled with United's decisions to phase out small-body aircraft, led to a winding down of the United contract through FY23 and AW contracting with AA.

In February 2024, arbitrators determined that United did not owe AW the disputed payments. Given AW recorded these disputed payments as revenue in its financial statements, the Company will be restating its financials from Q1 FY22 through Q3 FY23 (but there will be no impact on the Company’s cash or marketable securities balances).

This was clearly a surprising outcome for the Company - I estimate Harbor spent ~$15m in legal expenses over the past year or so with zero returns, which is substantial for a company of this size. The market also seemed to be surprised, with the Company's stock down ~15% following the announcement.

But with the United dispute behind Harbor, I believe investors will, over time, shift focus back to the Company's core operations. With legal expenses falling away after Q1 FY24, I would expect the Company to generate positive FCF through the year, which should drive a re-rating as investors see cash generation. And, to the extent the dispute was a distraction for the Company, Harbor's management can once again focus on its core operations and longer-term planning.

Value Proposition

Regional airlines (we'll call them 'regionals') like Harbor are critical partners for major airlines (we'll call them 'majors') like AA. Over time, the majors have built highly profitable 'hub-and-spoke' network systems in which majors consolidate passengers from multiple origins onto fewer, fuller planes through a central hub airport. This improves efficiency by maximizing aircraft utilization and allows majors to take advantage of economies of scale, reducing costs.

The video below describes the hub-and-spoke model in more detail:

Many cities' airports are too small to justify larger aircraft, so regionals with smaller planes help feed the majors' hubs. This is highly profitable for majors and important in generating economies of scale.

Imagine a couple flying from a small airport through JFK and then on to Paris - If a regional does not pick up the passengers initially from the small airport, the major has essentially lost two potential sales (the ticket to JFK and the ticket to Paris). In addition, the use of a regional is less costly for a major, given they don't need to spend upfront capex for new planes, higher incremental pilots, etc.

How are these arrangements structured in practice? Contracts differ across the industry differ, but AW operates its jets (including flying, in-flight service, etc.) on behalf of AA, while AA largely handles everything other than actual in-flight operations, including route selection/scheduling, pricing (with ticketing revenue flowing directly to AA), and marketing.

The AW/AA contract is essentially structured as a cost-plus arrangement - AW is paid a fixed rate per departure and block hour (defined as the time between when an aircraft's door closes at departure and when it opens at arrival after landing) and an additional fixed amount per covered aircraft under the agreement (subject to utilization thresholds). In addition, AW is reimbursed by AA for all major operating costs (including fuel, but excluding personnel costs and airplane maintenance), minimizing AW's volatility.

Regionals have become even more important in the last few years given the ongoing pilot shortage in the U.S., driven by pilots taking early retirements in the face of an uncertain demand environment during COVID. This was clearly a driver of the AW contract for AA (see below an excerpt from AA's Q3 FY22 earnings call) - It would be difficult for AA to find these pilots elsewhere.

The industry is increasing pilot pay to entice new pilots to join the workforce, and this cost is often being eaten by the majors through higher payments to the regionals (this cost is, of course, subsequently passed on to customers in the form of higher ticket prices). You can see this in the recent changes to the United and Mesa Air Group (another regional) contract.

AA has taken similar actions with AW, signing two amendments to the contract in February and November 2023 which provide one-time payments for increased costs associated with pilot compensation (following a new pilot union contract) and increased rates from 2023-2028 related to pilot compensation/retention.

This goes to show just how important regionals are to majors. AA is AW's sole revenue source, and they know it. Rather than squeeze AW's margins, AA chose to pay AW more in the face of rising costs because AW's pilots are important to AA's own operations - AW's pilots deliver passengers that are highly profitable to AA, and it would be difficult for AA to find these pilots elsewhere.

Said differently, AA wants AW to survive. It's not in AA's interest to drive AW's margins down so far that pilots need to be laid off, planes need to be shut down, etc., and their actions show that.

Ownership and Capital Allocation

As mentioned, Harbor is essentially a controlled entity - 32.4% of the Company's diluted shares are owned by Amun LLC ("Amun") and 100% of outstanding Convertible Preferred Stock is owned by Southshore Aircraft Holdings ("Southshore", immediately convertible into 16.5m shares, representing 26.7% of FDSO).

Richard Bartlett, one of Harbor's directors, is indicated in the filings to be the beneficial owner of both ownership stakes above, and as a result, is presented as having ~60% ownership of the Company. In reality, Bartlett only owns 25.6% of each of Amun and Southshore and does not control voting or investment decisions for either entity.

Digging through the filings, you can piece together the remaining owners of Amun and Southshore:

Richard Bartlett: 25.6%

Jerry Seslowe: 17.6%

John Shaw: 17.6%

Geoffrey Crowley: 12.4%

William Jordan: 12.4%

Patrick Thompson: 12.4%

So who are these guys? Bartlett, Seslowe, and Shaw are each 33% owners in Resource Holdings ("RH"). Seslowe was an investment banker for famous businessmen Philip Anschutz and Jay Pritzker, both of whom helped seed RH, a merchant bank, in 1983. I believe Shaw was another founder of RH, and Bartlett joined as a 29yr old in 1984 (leaving a law track to join Wall Street).

In addition to Anschutz and Pritzker, RH was advising and running capital (and thus seemingly had the trust) of some very smart individuals. There are limited public details available, but some examples include RH putting Conwood in front of Berkshire Hathaway and RH bidding with First Boston for RJR Nabisco.

In 1993, an entity called CJT Holdings ("CJT") acquired Air Wisconsin's regional jet airline business from United (which would become AW). CJT was a partnership controlled by Crowley, a former Northwest Airlines executive who would become CEO of AW, and the principals of RH, identified as Bartlett, Seslowe, and Shaw. This means that RH has been involved with AW for ~30yrs.

While it's hard to know exactly what RH's return on AW has been since the initial investment, AW's participation in the US Airways bankruptcy indicates unique, savvy capital allocation by RH. In 2005, AW's financing arm, called Eastshore Aviation ("Eastshore"), provided $125m in funding to US Airways during its bankruptcy, which would equal ~14% of US Airways equity post-emergence.

As part of this agreement, US Airways contracted AW to deploy 70 regional jets on its network, providing AW with cashflows for years to come. Importantly, based on publicly available Form 4s, we can see that over the next two years, Eastshore would sell ~65% of its US Airways stock for a ~62% IRR and 1.9x MOIC. This was a highly successful investment and points to sophisticated investment acumen at RH.

RH showed this again in 2011 when they bought 2m shares of Series A Preferred Stock of Harbor (then a failing biotech company called Harbor BioSciences) through Amun, representing 28% of economic interest in the Company and 38% of voting power. The prefs allowed Amun to appoint three directors to the Board (Bartlett, Seslowe, and Shaw) and make the Company 'go-dark' (i.e. stop reporting financials publicly).

In exchange for the prefs, Amun put $2.8m in cash into escrow for the Company's use and said it would bring to the Company an offer to acquire a controlling interest in a profitable entity. This entity would be AW, with 80% acquired in 2012 and the remaining 20% bought in 2016.

Essentially, RH took control of a public shell company by putting up $2.8m in escrow that would eventually merge into AW. Why did they do this? Solely for tax reasons - At the time, Harbor had $190m of pre-tax federal net operating losses ("NOLs") that could be used to offset AW's (presumably large) taxable income.

RH had operated AW privately for almost ~20yrs and likely had no interest in taking it public, but saw the opportunity to take advantage of a huge amount of tax assets for an extremely cheap valuation. Given the lack of Harbor filings after going dark, we don't know to what extent the NOLs were utilized, but I would assume RH and AW did very well on the transaction, given almost no money was put down for the tax assets.

Harbor would've likely stayed dark, but following a legal battle initiated by a shareholder, the Company was forced to resume filing reports in 2020.

Here's where things get a little tricky - Before filing its first public report, Harbor entered into a related-party transaction with Southshore (which as we know, is also owned by RH). Harbor acquired 3 CRJ-200 regional jets, each with two engines, plus five additional engines and in exchange, issued 4m of 6% Series C Convertible Preferreds to Southshore, valued at ~$13.2m and convertible into 16.5m shares, representing ~25% of FDSO at the time.

This was an extremely expensive transaction - RH essentially diluted minority shareholders by 25%, costing them millions in value, for 3 planes that they could've otherwise purchased for <$500k each. This was clearly an unfair transaction. I have to assume RH wanted to pay themselves a bonus of some sort prior to fully 'going public' again.

This is a tough one - On one hand, the transaction screwed minority shareholders (they hadn't seen the financials in nearly 10yrs and couldn't vote on the issuance), but on the other hand, you could stretch and argue that RH earned a bonus.

Prior to RH's involvement, shareholders in the old Harbor BioSciences owned 100% of a company that was worth ~$7m. Today, shareholders (excluding RH-affiliates) own ~40% of a company (after dilution) that is worth ~$100m (which I believe is undervalued today). Despite the expensive convertible preferred issuance, that comes out to a very strong ~14% CAGR over 13yrs for any shareholder that stayed invested alongside RH.

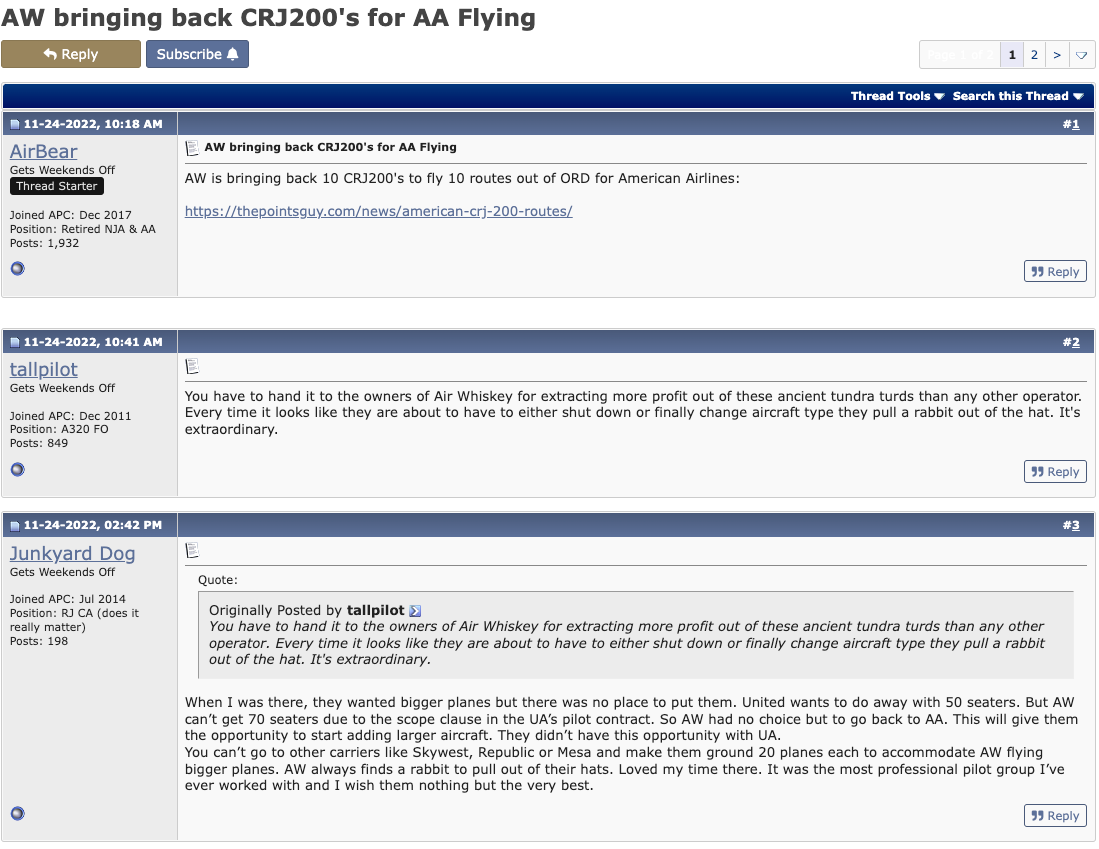

Other than that transaction, I think AW and RH have made a number of value-generative moves for shareholders. Most importantly, they've managed to keep AW alive much longer than anyone thought they could. Below is a screenshot from a popular pilot forum ('Air Whiskey' refers to AW):

The Company has also spent ~$20m on share repurchases since Q2 FY21 (representing ~20% of FCF produced over that time), returning capital to shareholders despite a very illiquid stock. I just don't think RH would engage in any form of capital returns if their goal was to steal from minority shareholders.

RH has done some good and some bad, but they're clearly talented investors and airline operators. There are of course risks (RH's treatment of minority shareholders hasn't been ideal), but I'd back the long-time AW owners to make money from here through Harbor. At the moment, the Company is priced like that isn't the case.

Hi Rohan,

I wrote up HRBR on Costel’s newsletter. I would love to chat if you have time about the company. My email is costel@degcap.com

I agree. How long can they procrastinate with the filings? They use the term “practicable” which doesn’t give us a good feeling it will come by any certain date. In the meantime they are retiring the stock at very cheap prices from people who are not up to date with information. Notice also that no one in management owns any stock at all. So they are paid well but have no incentive to increase the price of the stock.