On Otello's ($OSE.OTEC) Stake in Bemobi

Otello's stake in Bemobi trades at ~1.5x EBITDA on a look-through basis, despite growing double digits in SaaS/Payments with ~30% EBITDA margins and a new board committed to maximizing SH value

Note: All numbers presented in USD for ease of comparison, unless otherwise noted. All Bemobi numbers presented on a net/harmonized basis (i.e. excluding retail passthrough revenue), unless otherwise noted.

Situation Overview

Otello Corporation ("Otello", "$OTEC", or "the Company"), formerly known as Opera Software, is a Norwegian holding company. Over the past 10 years, the Company has completed a series of divestitures, including its (former) namesake product, the Opera Web Browser.

Today, the Company has no remaining operations and only one major asset left: A ~38% stake in a publicly traded Brazilian software and payments company called Bemobi Mobile ("Bemobi" or "$BMOB3"), which the Company first acquired in 2015 and took public on the Brazilian B3 stock exchange in 2021. The former CEO of Otello, Lars Boilesen, remains the chairman of Bemobi's board.

The investment case for Otello at its most basic level is quite simple - Otello trades below liquidation value, priced by the market as if it were worth more dead than alive. At current prices and FX rates, Otello trades in Norway at a market cap of ~$55m. Its proportional stake in Bemobi, however, trades in Brazil at a valuation of ~$80m.

The disconnect should immediately be clear - Theoretically (and far too simplistically), if you had ~$55m, you could buy all of the Company's outstanding shares, sell the entire Bemobi stake at market prices for ~$80m, and immediately pocket the difference (~45% upside).

A more realistic look at my calculations of the Company's enterprise value is below:

Note: PF cash outflow for buybacks is an approximation of the amount used to buyback shares by Otello based on shares bought back since year-end and the average price of the stock since 12/31/24 (eyeballed at NOK7.70) at today's FX

Importantly, there's reason to believe this discount will be reduced/realized in the medium term. In January 2025, a minority investor group, led by Norwegian investors/activists Svend Egil Larsen and Lars Brandeggen, with support from Otello's two largest shareholders, British special situation funds Sand Grove Capital and Kite Lake Capital, implemented a new board at Otello.

From various news articles and podcasts (I recommend this one and this one - I have English transcripts that I'm happy to share in case of interest, just reach out), it's clear that the new board's primary mandate is cost reduction at the Otello level (I estimate ~$2.0-2.5m in Otello OpEx this year), to improve shareholder value.

In addition, the board has indicated an "opportunistic view" on Otello's "financial investment" in Bemobi, a stated focus on maximizing shareholder value, and a "strengthening of ownership engagement with Bemobi."

Otello - H2 FY24 Report

They also indicated potential for further share buybacks - Otello has historically used its cash pile (currently ~$10m) and dividends from Bemobi (~$3.5m this year) to buyback shares (~$3m spent in FY24 vs. ~$55m Otello market cap). This is, of course, a very accretive use of capital given the discount that Otello is trading vs. Bemobi.

All of the above are steps that are focused on realizing and returning value to Otello shareholders, which should help reduce the discount over time. I wouldn't be surprised to see more substantive actions in the future, such as larger distributions from Bemobi or a potential sale of Otello's stake.

We could stop here, but that's only one way to look at this investment.

More interesting (to me) is not to look at this on a liquidation basis, but rather on a look-through basis. Remember, at current prices, you could buy all of Otello, namely it's ~38% stake in Bemobi, for ~$55m. Bemobi has underlying business operations - What does this price imply for the valuation of Bemobi? And is this a business you would want to own at that valuation?

I would say yes - Bemobi is a capital light SaaS engagement platform with a rapidly growing integrated payments offering targeting enterprise customers in Brazil, an increasingly digital country. Initially focused solely on telecom players, Bemobi has managed to penetrate other verticals that have similar recurring payment structures, including electric distributors, education companies, and internet service providers ("ISPs").

Bemobi is a ~30% EBITDA margin company with accelerating revenue growth (~6% YoY over the LTM period, ~15% YoY in Q3 FY24) as its 'Vertical Payments' strategy (SaaS and Payments, ~22% and ~35% of LTM revenue, respectively) continues to take off through both new clients and deeper penetration with existing clients. Total Payments Value ("TPV") processed through Bemobi's solutions grew a whopping ~30%+ YoY in the LTM period to ~R$7.8bn (with Bemobi maintaining a ~2.5% take-rate).

I can't comment on the accuracy of this estimate, but as a datapoint, Itaú forecasts Payments segment revenue to grow 30%+ YoY in FY25E as recent customer wins continue to ramp. Regardless of the exact amount of Payments growth, it's clear this will be a key driver of consolidated company growth over time.

We'll discuss Bemobi's offerings in more detail, but just to give you a sense of the success of its value proposition: From zero enterprise clients in 2021, Bemobi has captured five out of the six largest private electric distribution companies in Brazil through its Payments vertical, representing ~60%+ of electricity distribution TPV in the country that Bemobi can potentially convert (a larger opportunity than its main telecom vertical, which continues to ramp/grow).

Itaú - Bemobi Report (July 2024)

These are sticky, recurring contracts that have long decision cycles and implementation times - That is to say, these are (presumably) not easy contracts to win and are hard contracts to lose. Bemobi announced in Q3 FY24 its first enterprise-level Payments contracts in the education and ISP industries, representing further growth opportunities in new verticals. Today, ~25% of Bemobi's TPV is non-telecom related.

What's this all worth? On a look-through basis, you can buy Bemobi through Otello at an implied ~1.5x EV/EBITDA or ~2.4x EV/(EBITDA less CapEx). A deeper look at my calculations is below:

Note: Bemobi LTM EBITDA based on my own calculations - Adjusted for IFRS-16, no add-back of non-recurring expenses that seem to be part of business model (restructuring, costs of new acquisitions, and long-term incentives plan intended for Bemobi’s executives), and adjustments for non-cash write-offs/impairments, deferred payments, and SBC. Otello HoldCo costs based on FY24 OpEx per H2 FY24 report

There are a lot of things you can get stuck on with an investment in Otello/Bemobi.

First, there are operational risks, like potential for value destructive M&A at the Bemobi level with its large cash balance and customer concentration in the telecom space. It's worth noting, however, that Bemobi has actually been quite measured on M&A - ~25% of FCF since FY22 has been spent on acquisitions (which, I would argue, has been accretive/important to driving the Payments vertical), while ~45% has been spent on shareholder returns (dividends and buybacks). Additionally, Bemobi continues to diversify away from telecom (although it continues to be exposed to large enterprises with presumably high negotiating power).

There's also, of course, macro and corporate structure risks, including underlying operations being located in Brazil (potentially volatile government/interest rate/FX situation), tax implications on Otello if there is a sale of Bemobi, etc.

Those are all valid concerns and warrant additional work. All that said, I haven't found many assets globally with this growth and margin profile trading at less than 2x EBITDA. While there isn't a hard catalyst here per se, a potential rerating could be driven by corporate actions to realize value at Otello or continued growth in Bemobi's Payments vertical (driving consolidated revenue growth over time).

The remainder of this post will be a brief/broad overview of Bemobi's operations (happy to discuss more in the comments).

But first, why does this opportunity exist?

There are a few reasons that come to mind. One is that Otello is an oddly structured company with no natural buyer base - You're buying a Norwegian stock with its only assets based in Brazil, a country with poor market sentiment given government/interest rate/FX concerns.

Otello's formerly largest shareholder, Sand Grove Capital (~30%+ owner as of year-end FY23), has also been selling down its stake, presumably driving pressure on Otello's stock price. I don't know why they're selling after the board change (despite supporting the new board), but, for what it's worth, they have been involved with the Company for quite some time (at least since 2019).

Lastly, Bemobi may not be getting sufficient credit for its business quality and the growth/acceleration in its Payment strategy. As you can see below, Bemobi trades at a discount to the broader (already cheap) Brazilian market (represented by IBX below as a proxy), despite what I would consider higher quality operations.

This could be driven by its market capitalization and low float (<40% not held by major shareholders), but also could be due to certain accounting quirks. Bemobi doesn't screen particularly well from a margin perspective as it includes certain passthrough revenue in its accounting statements, inflating revenue and depressing margins. For example, Bloomberg shows Bemobi's LTM EBITDA margins at ~13% vs. my calculation of ~30% excluding passthrough revenue.

Bemobi Overview

Since its founding in 2009 (and particularly after its IPO in 2021), Bemobi has transformed under founder/CEO and ~5% shareholder Pedro Ripper, supported by ~38% shareholder Otello.

Bemobi was historically a B2B2C subscription app services provider for global telecom customers - The company's main offering was a "Netflix-style” service called AppsClub, allowing Android end-users access to unlimited premium mobile apps for a small subscription fee. Mobile providers would collect this fee from end-users and pay a portion to Bemobi, who would in turn pay a portion to developers for app licensing.

Since 2019, organic initiatives and M&A, most notably Bemobi's acquisition of its former parent company M4U in 2021, have completely shifted the business model. The aforementioned AppsClub offering, referred to by Bemobi as its Subscription segment, has declined from ~82% of revenue at IPO in 2021 to ~30% of revenue in Q3 FY24.

Bemobi's new solutions are broad-based and include digital payments, customer engagement, microfinance, and digital services offerings. Importantly, Bemobi has managed to successfully diversify away from its initial telecom customer base, now additionally servicing the energy distribution, education, ISP, and finance sectors, including nine of the top 15 recurring service companies in Brazil.

Today, Bemobi has four main revenue streams:

Vertical Payments: ~58% of LTM revenue, ~10.6% LTM growth YoY. Made up of the following revenue streams:

Payments: ~35% of LTM revenue, ~11.6% LTM growth YoY

SaaS: ~22% of LTM revenue, ~9.2% LTM growth YoY

Subscriptions (AppsClub): ~30% of LTM revenue, ~0.2% LTM growth YoY

Microfinance: ~12% of LTM revenue, ~3.5% LTM growth YoY

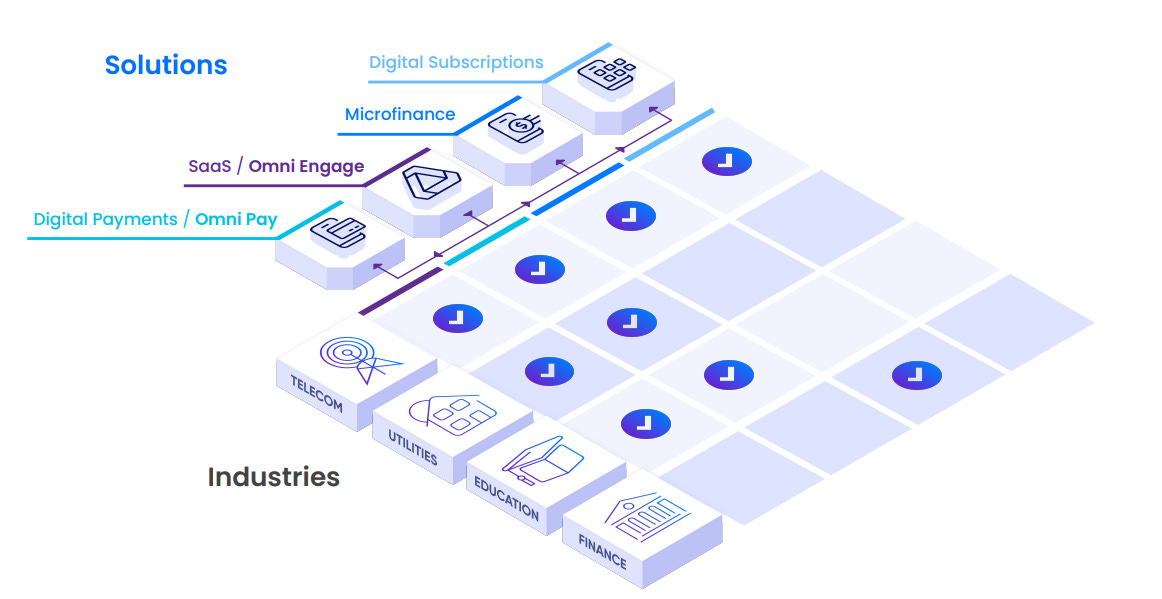

Below is a matrix highlighting Bemobi's offerings and major target industries.

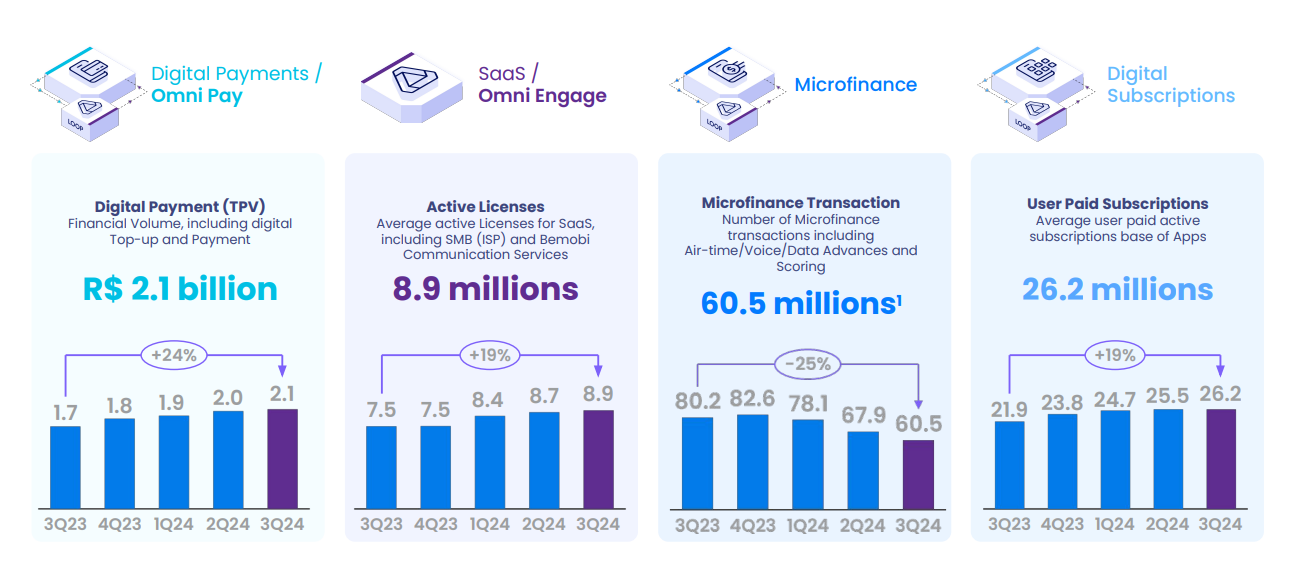

I've also included below a snapshot of the B2C KPIs that Bemobi tracks for each of its underlying revenue streams. All underlying segments continue to show strong growth following a weak FY23, impacted by the sale of Oi (a large Brazilian telecom player and Bemobi customer). Note that Microfinance transactions were impacted by removal of lower margin contracts and therefore improved mix - The segment actually grew revenue ~8% YoY in Q3 FY24.

As you can see, Vertical Payments is the largest and fastest growing vertical, and is likely to be the core driver of Bemobi's growth going forward.

On the SaaS side, Bemobi offers a white-label solution called OmniEngage, which helps customers engage their end-clients across channels (web, voice, social, messages, etc.) based on customer profiles, customized for each of Bemobi's key industries (telecom, utilities, etc.).

Clients use this solution to drive end-customers to their offerings when most relevant - Take for example an individual with a pre-paid mobile plan (a common structure in developing countries where customers pay for mobile services upfront and recharge as needed) that is running low on credits (needed to use mobile data, make calls/texts, etc.).

OmniEngage can help telecom customers redirect such end-users to portals where they can 'top-up' their credits based on the most relevant channel for that particular customer (e.g. a captive web page if they are currently browsing the internet, through WhatsApp if they are currently texting, etc.). OmniEngage can also help the customer design and run personalized promotional campaigns if relevant.

The below video explains the above use case well:

On the Payments side, Bemobi offers a white-label solution called OmniPay, which provides customers with a complete payments solution, allowing end-users to actually pay their bills in a seamless fashion.

The offering includes multiple payment methods (credit/debit cards, instant payments (PIX), wallets, etc.; Having varied payments methods is particularly important given increasing digitization in Brazil), an anti-fraud offering, and an engine for recurring payments (which typically have high risk of failure due to card reissuance, inability to notify users of any failures, etc.).

OmniPay integrates directly with OmniEngage, and this combination addresses significant challenges for Bemobi's customers. The first major challenge is crippling levels of bad debt - As a datapoint, the average first month bad-debt in Brazil for electric distributors is ~20%+. The second is rapidly growing digitization in a country that has historically relied heavily on physical payments (still representing ~50% of payments for electric distributors today).

Examples of problems customers currently face in the Brazilian electric distribution industry

Bemobi's customers do not have the core competencies to deal with either of these issues, but these issues do have a significant impact on their profitability and customer loyalty/satisfaction.

Through its integrated SaaS and Payments offering, Bemobi partners with customers to improve payments conversion, reduce defaults, reduce the cost of collection, and improve end-customer NPS and loyalty (in particular by reducing service failure of essential services).

As I mentioned before, the extent of these challenges for Brazilian companies and the importance of Bemobi's value proposition is best seen in the growth of Bemobi's electric distribution offering.

Bemobi, simply by leveraging and adapting its solutions from the telecom vertical, has managed to capture five out of the six largest private electric distribution companies in Brazil in its Payments segment (representing ~60%+ of electricity distribution TPV) in just a few years. These contracts continue to ramp and should drive continued Payments growth for years to come.

Bemobi sees similar industry problems (e.g. low payments conversion, significant bad debt/defaults/churn, etc.) in other recurring services industries including education providers and ISPs. The first enterprise level contracts in each of these industries were announced in Q3 FY24, representing potential growth drivers in the future. Today, ~25% of Bemobi's TPV is non-telecom related.

In terms of revenue model, Bemobi receives a take rate (~2.5% currently on a total company basis) on TPV that flows through OmiPay, while customers pay a fixed, recurring subscription payment for OmniEngage. In terms of go-to-market, the Company primarily leads with OmniEngage, cross-selling OmniPay over time. With 1,344 SaaS clients vs. 481 Payments clients currently, this represents another significant growth opportunity for Bemobi over time.

Tremendous writeup. And timely for those of us who've missed out on the Brazil rally so far. I've bookmarked for a second and third read.

Curious what you think of the Nowegians and Brits who replaced Otello's board. Any growth investors among them, or only corporate raider types? Does "strengthening our ownership engagement" mean they're about to push for a large distribution from Bemobi's cash pile, and would doing so affect Bemobi's growth or cap our long run upside in any obvious way?

Interesting idea. Why doesn't management distribute out Bemobi or liquidate the stake and wind up the company?