On Staffline's ($AIM.STAF) Market Share Growth

Despite a leading position in resilient temp staffing, substantial share growth in a soft market, consistent FCF under new mgmt, and 20% of shares repurchased in 2yrs, STAF trades at <3x EBITDA

Situation Overview

Staffline ("$AIM.STAF", or "the Company") is the largest provider of blue-collar temporary workers in the UK with ~10% market share, deploying an average of ~40k individuals daily across 400 on-site locations (largely warehouse and driving personnel). The Company today has a market capitalization of ~£55m, with temporary recruitment representing ~90% of total gross profit (the remainder is from permanent staffing solutions).

~55% of the Company's revenue is derived from the resilient food and beverage end-market, with another ~35% of revenue from the broader manufacturing, logistics, and driving sectors. Some of Staffline's largest customers include supermarkets like Tesco and Sainsbury's and third-party logistics firms like GXO.

Staffline's customer relationships are often sticky in nature with long-term relationships, underpinned by multi-year contracts and relatively recurring/visible temporary worker demand (naturally somewhat dependent on end-markets).

The Company has two main segments:

Recruitment GB (~80% of FY24 gross profit): Provides services in England, Scotland, and Wales

Recruitment Ireland (~20% of FY24 gross profit): Provides services in Northern Ireland and the Republic of Ireland

Over the past 5yrs+, Staffline has undergone a profound transformation in business operations.

Control failures and associated penalties (related to worker underpayments and accounting errors in FY18-19), poor execution with a bloated cost structure, and COVID all contributed to a significantly over-leveraged balance sheet under prior management, with a whopping ~£80m in net debt in FY19 against ~£7m in EBITDA (~11x net leverage), necessitating two equity raises in FY19 and FY21 to fully recapitalize the business. Today, Staffline's balance sheet is in a net cash position.

A management and board revamp was implemented during FY19-FY21 to clean up the situation, with experienced, incentivized individuals put in place, most notably:

Frank Atkinson - Current Recruitment GB MD (joined November 2019)

Daniel Quint - Current CFO (joined December 2019)

Albert Ellis - Current CEO (joined March 2020; Previously CEO of technology recruitment and solutions group Harvey Nash for 14yrs)

Tom Spain - Current Chairman (appointed to the Board in July 2021). Tom Spain represents the largest shareholder, Henry Spain (~28% ownership), an investment management firm which he founded and continues to run today

Through a rigorous focus on reporting and governance, customer service and compliance, cost controls (reduction in overhead, exit of low margin contracts, etc.), working capital management, and disciplined investments, all of which remain key focuses today, the new team has managed to drive a ~4.5% and ~12.7% CAGR in core recruitment gross profit and adjusted EBIT (net of allocated corporate costs) over the past 3yrs.

The extent of cost controls implemented under the new team should not be understated. Through a reduction in administrative headcount, a streamlining of the property portfolio, and consolidation of 3rd party spend, Staffline has improved Recruitment GB Adjusted EBIT (net of corporate allocated costs) to gross profit conversion from ~10% in FY21 to ~14% in FY24 (~40%+ improvement).

This is exceptional performance in the context of the broader UK recruitment industry, which has felt the impact of rapidly rising interest rates, a significant tightening of UK labor markets, and weaker like-for-like retail sales/declining demand in many sectors.

Source: Zeus - Staffline Equity Research Report (4.8.25)

Of course, this is not an entirely fair comparison - These peers have different exposures (geographic, sector, etc.), with Staffline disproportionally helped by a larger temporary business model (which tends to be less cyclical). Still, the above benchmarking helps put Staffline's strong recent results in context.

How were these results achieved?

As the market share leader, Staffline has unique competitive advantages in an otherwise commoditized industry, namely its scale, brand name, and existing client relationships. Notably, Staffline's website is the most visited blue-collar recruitment website in the UK, with a large registered worker database of 1m+.

As a result, the Company is able to efficiently and more cost-effectively support its blue-chip client base than competitors - See below for some commentary on this specifically with regards to major supermarket chains Tesco and Morrisons. For the latter, Staffline is now the provider of >95% of their blue-collar temporary labor requirements.

"We are actually the number one by some margin, and we leverage our scale and reach. That is our single largest competitive advantage. -...- In Tesco particularly, we increased our market share through acquiring new depots from competitors and successfully demonstrating that we can deliver into those new depots at scale and manage transitions. -...- Then you've got Morrisons over there, where at the beginning of the year, we announced in 2024 that we had secured a sole suppliership." - CEO Albert Ellis, H2 FY24 Earnings Call (4.8.25)

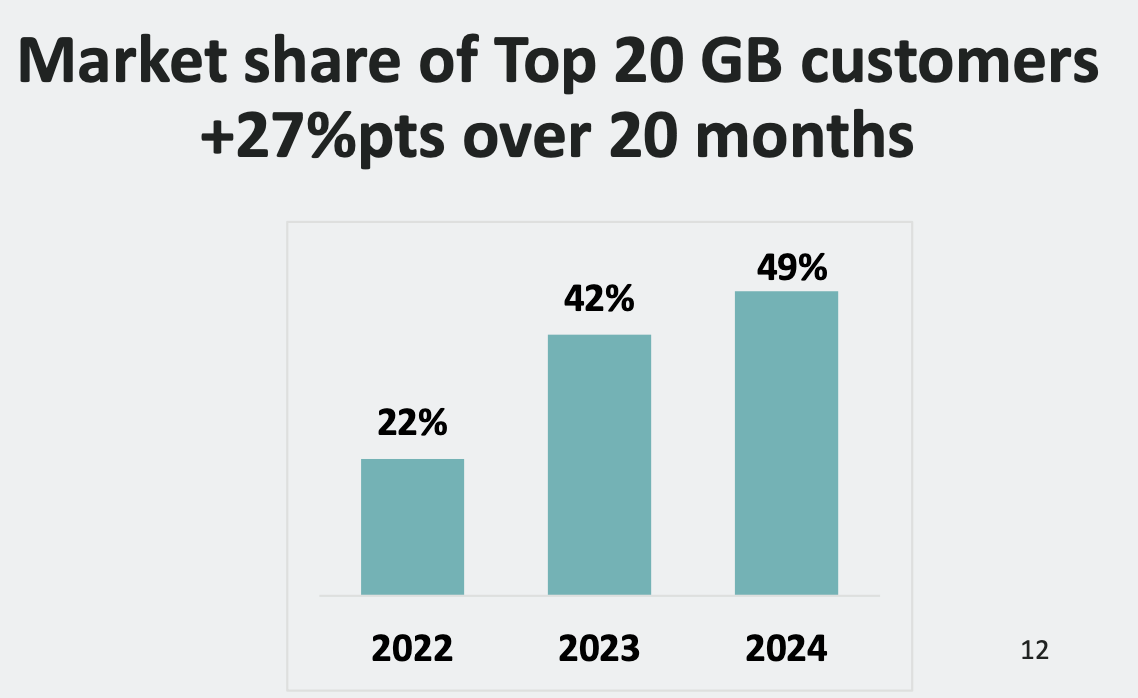

The above, coupled with managerial focus and a flight to quality in an uncertain market environment (driving an increased focus on compliance, service delivery, etc.), has seen the Company grow its share of available hours with its top 20 customers in Recruitment GB from ~22% in FY22 to ~49% in FY24, a key aspect of the Company's strong financial performance over this period.

Source: Staffline - FY24 Investor Presentation

Importantly, market share expansion has not been limited only to existing customers.

In May 2025, Staffline announced a major new multi-year contract win with Culina Group, a food and drinks supply chain management and logistics provider, to supply 100% of its agency labor services (currently provided by an in-house labor supplier).

I believe this award represents one of the Company's largest contract wins ever, only further demonstrating Staffline's ability to continue winning share while other competitors struggle due to softening labor market conditions.

This work is expected to ramp through Q3 FY25E - While there will likely be some upfront mobilization and working capital investments required, I estimate this contract alone will add ~7% to gross profit once fully ramped and add ~£2.5m to EBITDA.

Results have only continued to rapidly expand YTD, with Staffline indicating that temporary worker hours from Recruitment GB have increased 6.6% YoY for the first four months of 2025, driving a 6.2% increase in group-level gross profit YoY (before any contribution from the aforementioned contract win).

Despite significant operating improvements, clear market share expansion over the past 3-5yrs, and a recent run-up in the Company's stock price, Staffline has actually seen its stock price decline by ~55% since its FY21 peak, driven by ~70% multiple compression to a ~3x EBITDA valuation today.

Source: Bloomberg (5.26.25)

It's impossible to know exactly why the Company's stock price has reacted this way. One explanation could be the generally negative sentiment in the UK for both small/micro-caps and recruitment companies, although one could argue Staffline's customers may increasingly lean on temporary staffing for flexibility in an uncertain macro environment.

For what it's worth, Staffline is also an illiquid, tightly held company - The top three shareholders own >65% of shares outstanding (as a reminder, Tom Spain's firm Henry Spain owns ~28%).

Another potential factor we haven't covered is that Staffline's historical financials are not particularly clean/clear given the historical inclusion of the Company's PeoplePlus segment (~20% of FY24 gross profit prior to divestiture), a non-core asset that shrouded some of Staffline's success in its recruitment segments.

PeoplePlus is a provider of adult skills and training in the UK to prisoners and ex-offenders to help improve employability. Unlike the Company's core recruitment segments, this segment struggled post-COVID and, more recently, experienced delays in bid decisions for its contract pipeline following the UK general election, disproportionally impacting profitability given a largely fixed cost structure.

PeoplePlus was sold in February 2025 for net proceeds of up to £6.9m (including £2.0m in deferred consideration expected within 12 months; Sold at a strong multiple of >20x FY25E EBITDA per Zeus' forecasts). Going forward, the Company's financials will represent a pure-play, growing recruitment staffing company, which may ultimately help serve as a catalyst.

More important than any of the above is that the Company is actually taking advantage of this discrepancy in operational improvement and valuation to heavily buy back shares.

Over the past two years, Staffline has bought back ~20% of outstanding shares, with an additional buyback program currently ongoing (supported by proceeds from the PeoplePlus sale).

This is clearly heavily driven by Chairman Tom Spain, someone who is ingrained in the 'value investing' school of thought. Per his bio on the Henry Spain website: "Tom will read and spread enthusiasm of the likes of Warren Buffett, Benjamin Graham, and Phil Fisher." He has also clearly helped instill a culture of operational efficiency at the Company.

I've included below a selection of quotes from Spain's Chairman's Statements over the past few years, which provide a good overview of how he thinks about operations and capital allocation. Based on Spain's commentary, I would expect the Company to approach capital allocation flexibly, but continue buying back shares at this valuation.

"I have long been a strong advocate of prudent cash management, making sure the business remains self-financing and avoiding an over-reliance on external borrowing." - FY22 Chairman's Statement

"The litmus test of creating shareholder value on a long-term basis will be how well we use the profits generated by the business. The elegant name given to such decisions is “capital allocation”. In simple terms, the success of any business is how well management make decisions on retained cash and its reinvestment, as well as their choices about when and how to redistribute that cash to shareholders.

-...- With buybacks, the company purchases shares from investors who want to sell them (perhaps because they need the money, or perhaps because they have forgotten the reason why they bought their shares in the first place). When cancelling these shares after purchase, their proportional ownership of the business grows for those who hold on to their shares, as well as their claim on any future cashflows.

-...- While we won’t provide a running commentary on what we regard the intrinsic value of the Company to be, we will repurchase shares when they are trading at a substantial discount to what we believe they are worth." - FY23 Chairman's Statement

"Our primary objective is increasing per-share intrinsic value. While short-term results may not always be immediately apparent, our responsibility lies in the long-term value we create.

-...- Market volatility often creates discrepancies between price and value. When our shares trade at a significant discount to their intrinsic value, we will act decisively — reducing shares outstanding and increasing each shareholder’s claim on future cash flows. Conversely, when no such discount exists, we will preserve capital and allocate it prudently."

-...- For a business to be run with an ownership mindset, its leaders must first be significant owners themselves. With a major shareholder at the helm, we are committed to reshaping Staffline’s culture from the top down.

Our strategy is to transform the business into a cash-generating machine rather than a cash-consuming one. Given our inherently thin margins, success requires a relentless focus on efficiency — reducing expenses, improving cost structures, and embedding a culture of financial discipline. Incentives must be aligned with value creation because, as the saying goes: “Show me the incentive, and I will show you the outcome.”" - FY24 Chairman's Statement

So what's it all worth?

I estimate that the Company trades at <3x EBITDA (adjusted for the recent Culina Group contract win) and a ~11.5% normalized FCF / EV Yield, assuming no further market share gains.

While I have no view on whether the labor market and recruiting industry will improve or deteriorate from here, I think it's important to acknowledge that these segments have been weak for the past couple of years. In the event of any uptick in permanent recruiting in the UK and the Republic of Ireland, I think Staffline could benefit - While the segment only represents ~10% of total gross profit, it is currently depressed and will provide high margin revenue if/when it improves. Any further growth/market share gains would likely improve the above valuation.

The rest of this article will cover Staffline's business model and operations in a bit more detail.

Company Overview / Business Model

We've discussed the temporary staffing business model before (see my prior write-up on Ashley Services), but to reiterate: Agencies like Staffline allow customers to outsource the sourcing, hiring, and administration of flexible workers for a fee.

Temporary workers help customers deal with seasonal/fluctuating demand (e.g. peak workloads during the run-up to Christmas) and unexpected absences from full-time employees, and may even be leaned on in tight labor markets when customers are struggling to fill full-time positions.

Under typically multi-year contracts, customers work with Staffline to provide temporary workers (largely warehouse and driving personnel) with assignment information schedules that outline location, shift patterns, and expected hours. To be clear, these expected hours are not binding - The amount of hours worked is ultimately subject to client demand (which, in turn, is based on end-customer demand).

Source: Staffline Website (5.26.25)

Note: An example of a Sainsbury's job that the Company is currently hiring for

Workers, upon the completion of their shifts, are paid their wages by Staffline (weekly, biweekly, etc.). The customer later reimburses Staffline for these wage costs plus a fixed fee per hour (typically within 60-90 days).

From an accounting perspective, you should focus on the dollar value of Staffline's gross profit, which reflects these fixed fees. The revenue line item is inflated by temporary worker wages, which are passed through to customers. This pass-through can drive fluctuations in gross margins from period to period as labor costs increase, but does not impact the actual dollar value of gross profit/fixed fees.

When compared to the permanent recruiting model, temporary staffing can be potentially lower margin and more working capital intensive, with Staffline fronting the cost of worker wages before being reimbursed by its customers at a later date.

However, as is industry practice, the Company has (under the new management team) increasingly utilized various receivables financing arrangements (including an on-balance sheet financing facility and the sale of receivables through non-recourse customer financing arrangements) to settle receivables ahead of typical commercial terms, helping manage working capital and cash flows. The cost of these services is treated as financing expenses through the P&L, and is important to consider for any FCF modeling.

On the flip side, in contrast to the permanent recruiting model, temporary staffing tends to be more recurring/annuity-like with higher visibility and less cyclicality, particularly in Staffline's main end-markets (namely food and beverage logistics).

This, coupled with management's aforementioned focus on customer service, has led to long-standing relationships with key customers, with a ~95% retention rate and ~93% customer satisfaction in FY24 in Great Britain. The below is from ~5yrs ago, so we can imply that major customers like Tesco, Sainsbury's, and GXO now have ~15yr+ relationships with Staffline.

Source: Staffline - Investor Day (11.5.20)

As previously discussed, the Company has two main segments, each with slightly different characteristics:

Recruitment GB (~80% of FY24 gross profit)

Provides services in England, Scotland, and Wales. Market leader for blue-collar temporary workers in the UK with ~10% market share

Temporary / Permanent Recruitment Split (by FY24 Gross Profit): ~94% / ~6%

End-Markets (by FY24 Revenue): Food and Drink (~56%), Manufacturing (~16%), Logistics (~14%), Driving (~10%), Other (~4%)

Recruitment Ireland (~20% of FY24 gross profit)

Provides services in Northern Ireland (number two player with ~20%+ market share) and the Republic of Ireland (~2.5%+ market share, but a strategic focus for the Company)

Temporary / Permanent Recruitment Split (by FY24 Gross Profit): ~80% / ~20%

End-Markets (by FY24 Revenue): Food and Drink (~38%), Local Government (~35%), Industrial (~18%), Banking (6%), Other (3%)

In addition to capitalizing on existing market leadership in the UK and returning capital to shareholders, a core pillar of management's go-forward strategy is to drive higher margin permanent recruiting revenue over time. The thought is that the Company will be able to cross-sell permanent recruiting services to temporary recruiting clients without major incremental costs.

While permanent recruitment continued to see a slowdown in FY24 industry-wide, given reduced vacancies and candidate shortages/reluctance to leave existing roles, Staffline was actually able to drive increases in permanent recruitment by 17% YoY, albeit off of a relatively smaller base, driven by substantial new wins.

This was most notable in the Republic of Ireland, a strategic growth focus for the Company, where permanent revenue increased a whopping 58% YoY, driven by a major contract win with An Garda Síochána, the national police and security service of Ireland, helping cement Staffline Ireland's market position (given this was the Company's first major national contract in the region following a public procurement process).

Under this contract, Staffline will help An Garda hire permanent, white-collar back-office staff across the Human Resources, Medical, Finance, Legal, Engineering, and Administration fields. While this contact started slower than expected, it is now ramped and expected to provide a bigger impact in FY25E.

While not as large/material as the previously discussed Culina Group contract win (the CFO has indicated that An Garda should drive "hundreds of thousands of pounds of cash delivery in FY25E", it again shows Staffline's ability to drive market share growth in a difficult hiring environment and, importantly, management's ability to focus and execute.