On Table Trac ($TBTC) and Discounted Growth

Founder-led software company consistently growing due to superior tech and price. Existing maintenance revenue supports a sizable portion of current EV, with growth heavily discounted by the market

Table Trac ("$TBTC" or "the Company") is a ~$20m nanocap that owns CasinoTrac, a casino management system ("CMS"). Led by CTO/CEO Chad Hoehne (who founded the Company in 1995 and owns ~25% of outstanding shares), Table Trac currently offers its CMS to over 100 casino operators in 270 casinos worldwide (typically tribal or smaller commercial players in the U.S., with a presence in Australia, the Caribbean, and Central and South America), along with other ancillary products.

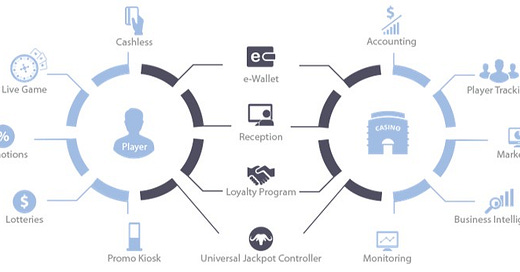

A CMS is integral to casino gaming operations - This is vertical software that allows casino operators to manage everything from accounting, ticketing/payment (increasingly cashless), player tracking, and loyalty solutions in one place. Without this software, casino operators are slow/inefficient and completely unable to make data-driven decisions, both of which hamper the potential amount of time customers spend in the casino and how much money they spend. This can be difficult to visualize for people that haven't spent much time in casinos, but IGT has a couple of informative videos on their Advantage CMS product that highlight the benefits of such a platform for both customers and operators:

Naturally, a CMS is highly sticky for casino operators and produces high margins with low capital intensity, but it's important to keep in mind this isn't SaaS - Given industry regulation, this software is on-prem, necessitating customer servers and hardware installation on gaming machines. Players in this space charge customers a large one-time installation fee, followed by recurring licensing and maintenance fees.

The CMS industry is dominated by slot machine manufactures, namely Light & Wonder (previously Scientific Games; owns Bally), IGT, Aristocrat, and Konami. This makes sense - Slot manufacturers are able to bundle CMS offerings with their slot machines when selling to casinos. At the same time, CMS is a relatively smaller and less important portion of the businesses of these companies vs. machines, leading to some underinvestment and potential opportunity. For example, expert network calls tend to indicate that Light & Wonder has ~40-50% of U.S. CMS market share, but that its CMS platform is difficult to maintain and build on. Some excerpts below:

"I mean just for the system side, right now, properties that have the Bally system, they have to have like 24 servers spun up, whether they're virtual or physical to run the system. I mean where like Aristocrat, you have like four servers. And you have to have probably three people full time just to manage at the property, just to manage the system where other systems, you have one guy that's a system administrator that does it." - Former Table Trac and Scientific Games Employee, Tegus Call (February 2022)

"It's just when I look at all the tools [Scientific Games] have available to them, there's certain things that just don't make any sense that they're not capitalizing on. Their platforms are very old. They're monolithic platforms that are very difficult to build on to. It's very expensive to get them to build anything for you. And I just think they're squandering some opportunities just because of lack of imagination, lack of innovation." - Former Scientific Games Employee, Tegus Call (February 2020)

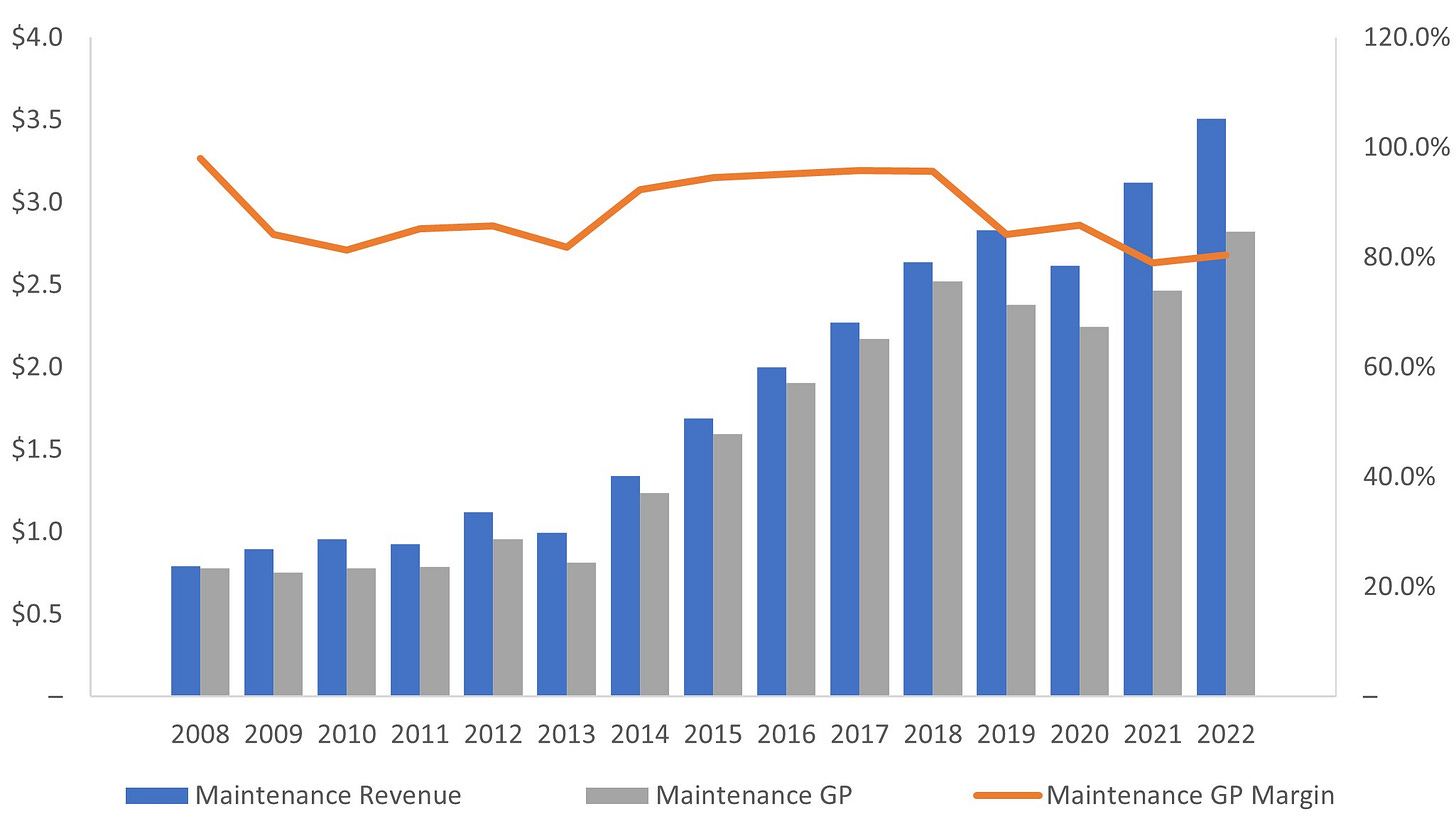

Table Trac is one of the companies taking advantage of the above dynamics, driving an ~11% CAGR in recurring maintenance revenue, a good proxy for the growth in intrinsic value of the Company given the more volatile nature of installation revenue, and a ~12% CAGR in the number of casino operators served from FY08-FY22. Maintenance gross margins have increased at a ~10% CAGR over that time period, representing slight margin degradation but still very healthy at 80%+.

These results are particularly impressive in the context of relatively high barriers to entry to new markets - The industry is highly regulated in the U.S., with Table Trac and other CMS providers requiring licenses to enter new states ($TBTC was recently granted a new license in Mississippi, in addition to existing licenses in Iowa, Maryland, Nevada, South Dakota, West Virginia, and Wisconsin). Growth has accelerated post-COIVD, with a ~16% CAGR in maintenance revenue from FY20-FY22 and a whopping 48% YoY maintenance revenue growth rate in Q2 FY23.

The below from a current employee sums up the value proposition of the Company well. With <$1m in maintenance revenue in FY08, the Company has grown to have a run-rate maintenance revenue of ~$5.0m today, driven by CasinoTrac's superior technology and lower total cost of ownership vs. competitors (unlike other providers, Table Trac does not charge for additional software modules or for upgrades).

"There are many unique benefits to selecting CasinoTrac as your casino management system. CasinoTrac is a full-featured, fully unified CMS stack; all our support is US-based and distributed strategically near customer sites. Our unique licensing models eliminate expensive third-party costs, upgrades are free forever and finally, the biggest differentiator is that we are a technology company only - we are not a box fabricator or game designer that also sells systems. Systems, as a business, is all we do." - Jeff Baldi (SVP Commercial Strategy), Gaming America (July 2023)

The excerpt below from a former employee provides additional insight into the Company's tech and potential (keep in mind this individual subsequently worked at Scientific Games):

"So I used to work for a small systems company before I worked for Sci Games called Table Trac, they're a publicly-traded company. They have a product called CasinoTrac. And this is a 20-person company, right? They do around $2 million a year in sales, right? I mean a very small company. But their system is top-notch. I mean it's a Linux-based system. It's easy to install. It's easy to integrate, the APIs for third-party integrations are simple, and it's just very linear. So I mean it's an easy system to run, to install, to learn. I mean, if somebody like Table Trac had the marketing prowess to actually go out there and the sales force, I mean, they could be a disruptor." - Former Table Trac and Scientific Games Employee, Tegus Call (February 2022)

Growth is obviously a key focus for the Company, and it looks like there is going to be additional investments in S&M to achieve this goal. I didn't find management to be overly promotional in my research, so this press release seems to represent a fairly strong signal: TABLE TRAC INC. INITIATES AGGRESSIVE EXPANSION PLAN. Furthermore, the Company has recently opened an office in Las Vegas to better showcase its offerings to a wider audience.

I won't dive too much deeper into Table Trac's offering - The Company has been written up previously by Zippy Capital, who provides an in-depth overview of the Company's history, TAM, and competitive advantages. I recommend checking the write-up out for more detail.

Instead, I want to discuss valuation. As alluded to earlier, maintenance revenue is really the key driver of intrinsic value here, given this revenue is sticky, high margin, recurring, and growth over time reflects the amount of business the Company is doing with its customers (maintenance revenue goes up as more casinos have CasinoTrac installations). It also has low capital intensity, and I would expect it to convert at a high level to FCF.

One way to think about the valuation is to strip out everything else and value the maintenance stream as if we were only investing in that portion of the business. That's of course not realistic nor the way the Company actually works - Table Trac needs to provide installations (generating installation revenue) to grow maintenance revenue, but I still think it's helpful for directional estimates of business value.

Let's assume maintenance revenue is flat going forward and that historical SG&A is allocated to each revenue line item (e.g. installation, maintenance, other, etc.) proportionally by revenue, implying ~35% FY22 EBIT margins for the maintenance 'business'. What would you pay for a business with those characteristics and minimal cashflow reinvestment needs? At a 10% discount rate, I'd probably pay somewhere between 6-7x EBIT.

You could argue that's too optimistic as there is some natural churn in the business (maintenance revenue declined by ~11% YoY in FY13 due to the loss of a customer), but I think the revenue base has historically proved to be resilient through difficult conditions (13% growth YoY in FY09 through the GFC and 8% YoY decline in FY20 through COVID) and any one customer loss is less likely today to have a material impact on total revenue just given the Company has continued to scale.

Q2 FY23 maintenance revenue is ~$1.24m, implying ~$5m in run rate maintenance revenue and $1.74m in run rate EBIT at 35% margins. At a 6.5x multiple, that gets me to ~$11.3m in value for the existing maintenance operation, compared to ~$15.7m in current enterprise value.

This means that ~70-75% of value is covered by today's sticky, recurring maintenance revenue base. Now, that value isn't definitively a floor for the stock. Obviously Table Trac could see material revenue declines, but the aforementioned industry dynamics and the historical growth of the Company indicate to me that this is unlikely.

All of the above is imprecise and directional at best, but I think the calculations show that the maintenance base of the Company supports a sizable portion of the entire enterprise value today, with an investor at today's prices getting any potential value associated with growth of the customer base at a low price.

Just how cheap is the growth being valued today? That's also hard to say exactly, but it could be substantial. Again, Q2 FY23 maintenance revenue grew a whopping 48% YoY. That's definitely unsustainable, but the growth indicates that the Company may be able to at least continue achieving something that approximates its historical maintenance revenue FY08-FY22 CAGR of ~11%.

Using the same math as before, we can derive the run-rate EBIT needed for the maintenance revenue base to completely support the $15.7m enterprise value, which would be $2.4m ($15.7m EV / 6.5x). It would take ~3yrs for the current run-rate EBIT of $1.74m to achieve that level if maintenance revenues compounded at the historical ~11% rate. Again, this is imprecise and directional, but if you think the Company will be able to increase maintenance revenues higher/longer than that calculation implies, the price the market is ascribing to Table Trac's growth today is likely too low.

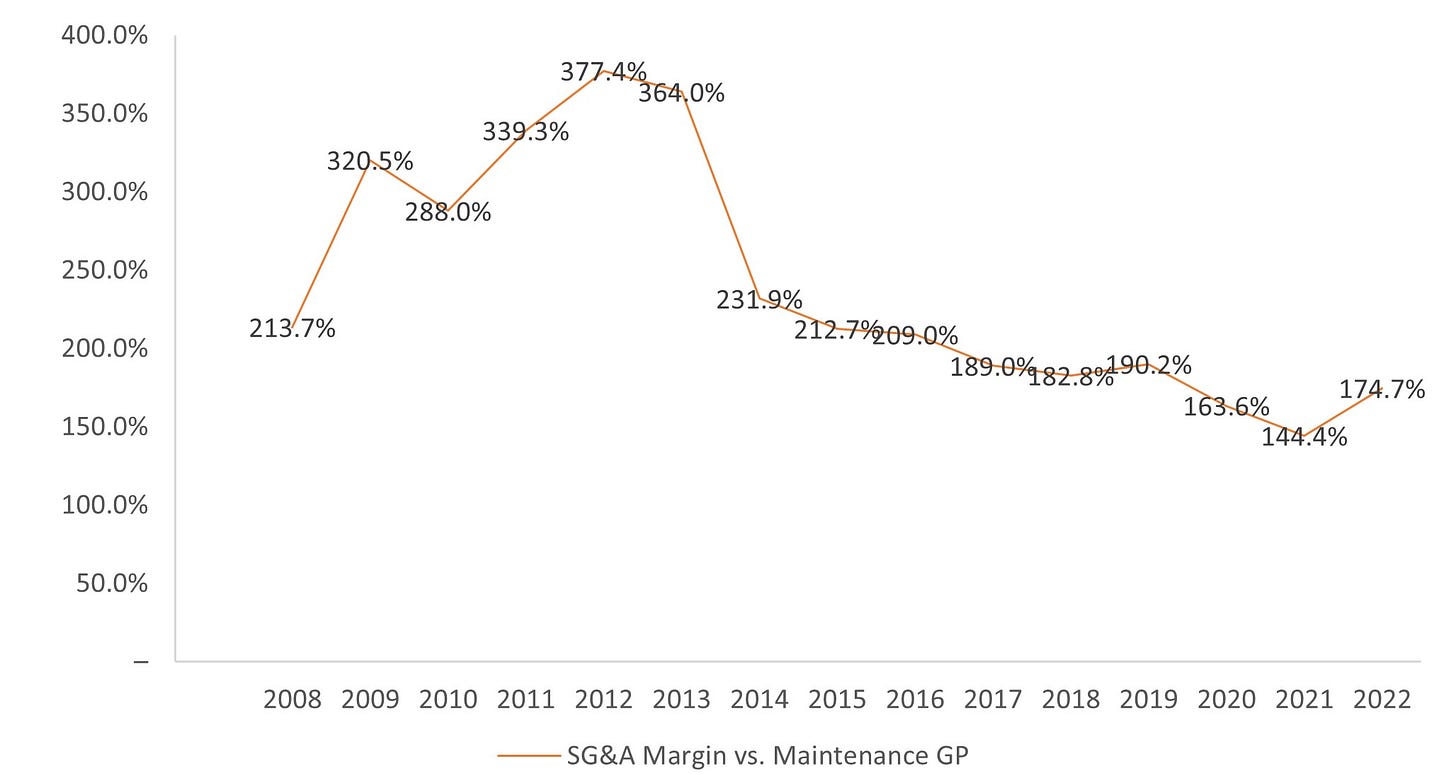

The above excludes the material amount of operating leverage the Company is beginning to see as it scales. This is best seen when comparing SG&A margin vs. maintenance gross profit (which approximates intrinsic gross profits) - The chart below indicates the Company is spending relatively less on SG&A vs. intrinsic gross profit over time. As a result, each incremental dollar of maintenance revenue going forward should be more valuable than each dollar previously.

One other point that's worth bringing up is that Table Trac is overcapitalized today - The Company historically held less than $2m in cash from FY08-FY20, however holds ~$4.7m in cash as of Q2 FY23. The Company began returning capital to shareholders in Q4 FY22 through a minor dividend, however I see the potential for a more substantial return of capital through either a special dividend or share repurchases. The latter would obviously be more beneficial given where the Company's stock is trading today.