On Rubius Therapeutics' ($RUBY) Liquidation

Ex-post analysis of a small, illiquid, but highly profitable (~300% IRR) liquidation investment and takeaways for similar opportunities in the future

Situation Overview

Rubius Therapeutics ("$RUBY", or "the Company") is a broken biotech that announced strategic alternatives in November 2022, ultimately culminating in a liquidation (approved by shareholders in April 2023 i.e. ~9 months ago).

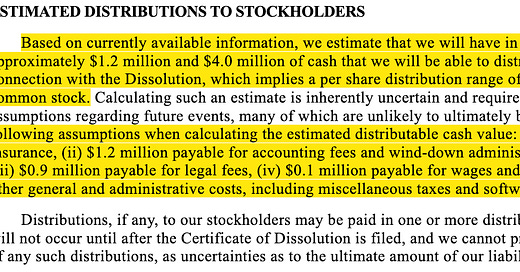

Earlier this week, shareholders received the initial distribution from the liquidation, amounting to ~$0.058/share, materially higher than the $0.01-0.04/share estimated per the March 2023 proxy (see below).

$RUBY traded somewhere in the ~$0.02/share range in the months following the release of the March 2023 proxy. Assuming you got shares at this price at the beginning of April 2023 (after liquidation approval by shareholders) and held through to early January 2024, the IRR would have been something like ~300% (excluding any incremental value from subsequent distributions, if any).

Note that IRR overstates the actual wealth generating ability of this opportunity - $RUBY's stock was illiquid and the Company had a market capitalization of <$2m at the aforementioned price, meaning a material amount of capital could not have realistically been deployed here.

Still, the results show incredible opportunities available in liquidations to investors with relatively small amounts of capital that I think are worth studying. As we know from the Cognitive Flexibility Theory Write-Up, we shouldn't derive any hard-and-fast rules/generalizable principles from the $RUBY liquidation, however this could be a helpful case study to reference in the future.

It's worth noting that, as mentioned in the Histogen Write-Up, I participated in the $RUBY liquidation. This was the first formal liquidation I've been involved in, but I'm under no illusion that returns in these situations will always be so profitable. And for the avoidance of any doubt, this is in no way meant to be a victory lap. In fact, I wouldn't be able to tell you why $RUBY's initial distribution was so much higher than estimated per the proxy, indicating some (potentially material) element of luck here.

Rather, I thought it would be helpful to get my ideas on paper (even if not actionable in this particular case) for both myself and others to draw on in the future, particularly as I wasn't in the habit of posting my ideas when I first got involved here. Of course, we should all be aware this is NOT good investment process (I'm analyzing with the benefit of hindsight and after a positive outcome, both of which drive bias), but hopefully it's still informative.

Analysis

What made the $RUBY situation attractive initially? An analysis of these factors will hopefully provide us with a better understanding of the drivers of the liquidation's fairly timely distribution and ultimate returns:

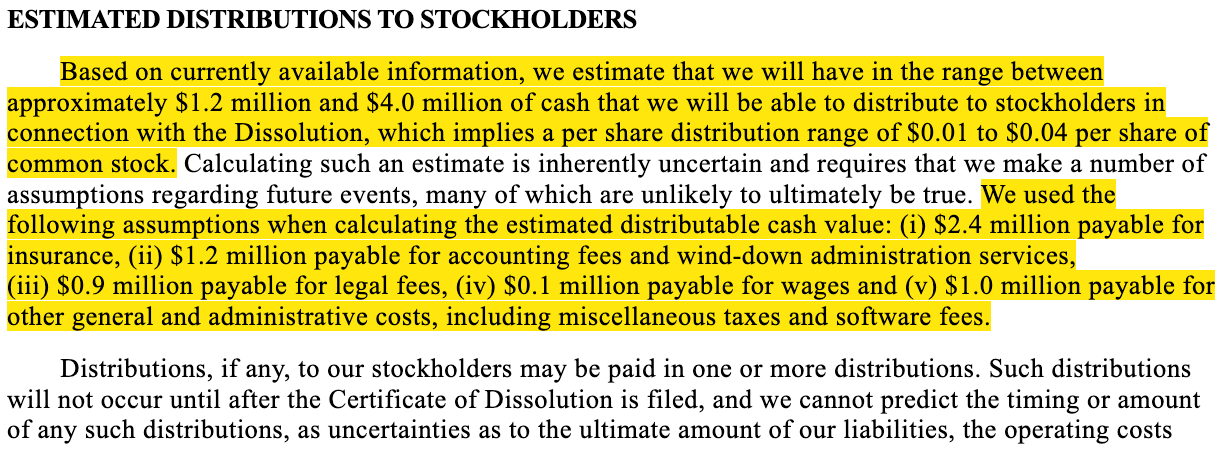

Very clean balance sheet per the FY22 10-K (see below), with the majority of assets held in cash and assets held for sale, offset only by clear, minimal liabilities that needed to be paid off. Also, there were no ongoing legal cases/settlements that may have impacted future value. The balance sheet made me incrementally more confident in any distribution estimates and timing, as the liquidation seemed like it would be straightforward

One could reasonably argue that the 'assets held for sale' value could be overstated, but the notes indicate the assets were "being actively marketed for sale at a price that is reasonable in relation to its current fair value." Additionally, the notes show that the Company had already received a ~$2m deposit for these assets. As a result, I gave the Company full credit for its assets held for sale, but this could be an important swing factor in valuation and should be sensitized in any underwriting case

The liquidation was seemingly likely to ultimately take place, reducing the risk of a reverse merger, resumption of clinical trials, or other potentially less favorable outcomes. By April 2023, not only had the liquidation been approved by shareholders (which is a big sticking point - Histogen's liquidation has STILL not been approved since I wrote it up in September 2023, materially impacting any investor's IRR), but the majority of employees had already been let go per the FY22 10-K (see below)

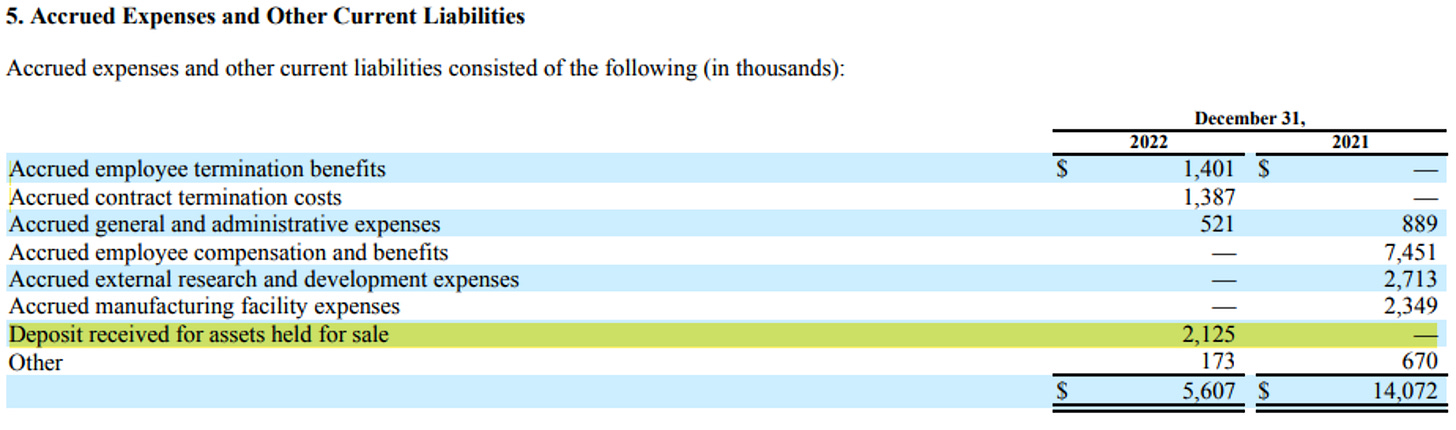

Substantial amounts of value based on a clear liquidation estimate from the proxy. While the estimated liquidation range was wide (at the ~$0.02/share price, the liquidation range of $0.01-0.04/share implied 50% downside to 100% upside), it was clear the main swing factor was the contingency reserve (management expected a reserve of between $1.4-4.2m). Assuming the midpoint of the contingency reserve estimate, an initial distribution 1yr after the liquidation approval, and a subsequent distribution 3yrs after liquidation approval (with 50% of the contingency reserve utilized), one could've feasibly underwritten to a ~70% IRR (taking management's other cost estimates at face value and, again, assuming full value for the assets held for sale)

Case #3 below would have a low-single-digit IRR if one were to assume only 50% value from the assets held for sale. I think this is too punitive, but highlighting again to show that this is an important factor in valuation

I think it's also helpful to contrast $RUBY with Sio Gene Therapies ("$SIOX"), which is another broken biotech undergoing a liquidation. The two companies have similarities - Both had liquidations approved by shareholders in April 2023 and both have very clean balance sheets (arguably $SIOX's is cleaner; $SIOX was profiled by Clark Street Value here).

Notably, $SIOX hasn't returned its initial distribution to shareholders yet. The comments of the Clark Street Value post (which are always insightful) point to the fact that this may in part be due to $SIOX's foreign operations, including its three subsidiaries in Ireland, England and Wales, and Switzerland (with one commentator indicating 2/3 subsidiaries have now been liquidated). In contrast, $RUBY had only one subsidiary, and it was based in the U.S.

This may be a premature point ($SIOX could distribute tomorrow for all we know), however it seems like foreign operations may play a role in elongating liquidation timing - This is worth tracking given the importance of timing to an investor's IRR. Valuation will naturally also play a role in any differences in returns between the two opportunities, but I won't get into that here.

Takeaways

As I mentioned, it's clear that liquidations can be highly profitable. I plan to look at more of these situations this year and, importantly, track the returns of various liquidations to get better at identifying good/bad opportunities to take advantage of. The difficulty is getting a hold of data around initial and subsequent distribution values from these liquidations as these stocks delist as part of the liquidation process (and therefore stop reporting).

To this end, it may make sense to start buying token amounts of stock in more liquidations (even if I'm not necessarily interested in a given opportunity) to get access to this data myself. This would allow me to build a database around returns and the criteria that make liquidations successful.

I envision tracking things like: Length of time to receive initial and subsequent distributions, typical amounts held back in reserves ($SIOX seemed to hold-back ~15% of liquid cash less total liabilities at the midpoint while $RUBY held back ~25% at the midpoint - I'm not yet sure if this is the right way to think about reserves), typical wind-down costs, etc. I'm not sure if such a database exists, but I'm sure it would be extremely helpful.

Great case study! For the contingency reserve, I guess it's possible that the company distributes more if a portion of it end up unused? do you know from past experience what's the percentage like?